Wages jump at fastest pace outside of Covid-19 but inflation erodes finances for 18th straight month

Workers in Britain have pocketed the largest pay increases on record outside of the Covid-19 pandemic, but inflation is still sharply eroding their finances, official figures out today reveals.

Numbers from the Office for National Statistics (ONS) showed the average worker in the UK received a 7.2 per cent wage increase in the three months to April, the largest barring the 7.3 per cent jump in the middle of the pandemic.

That jump was above the City and Bank of England’s expectations. Including bonuses, wages grew 6.5 per cent, also among the fastest increases on record.

Despite that bumper pay increase, inflation continues to wipe any gains for staff, signalling the tight grip the cost of living crunch has on family finances.

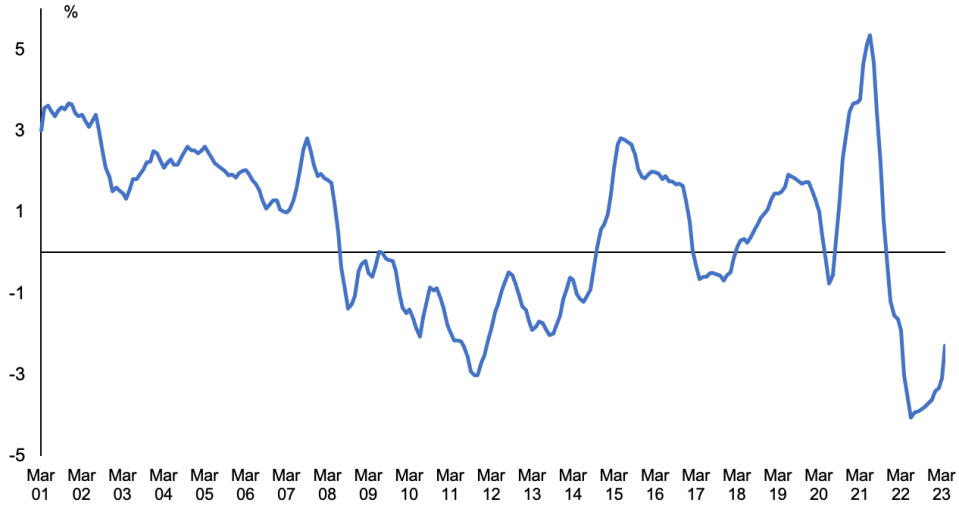

Over the same period, real incomes – which nets of inflation from pay growth – fell 2.3 per cent, the ONS said.

That means for 18 months in a row, UK households have suffered a drop in their living standards.

Chancellor Jeremy Hunt said: “Rising prices are continuing to eat into people’s pay checks – so we must stick to our plan to halve inflation this year to boost living standards.”

Pay has been partly driven up by the government signing off on a 9.7 per cent increase to the national minimum wage in April, although some firms would have raised wages prior to the new rate coming into force.

A shortage of workers, alongside existing and moving staff demanding bumper wage increases to protect their budgets from inflation, has also put upward pressure on wages.

Real wages have declined every month since November 2021

Around 442,000 more people since the onset of the Covid-19 pandemic are out of work and not looking for a job – known as economically inactive – due to long-term sickness, which experts have attributed to routine care being mothballed as a result of the huge NHS backlog.

Inactivity actually fell 0.4 percentage points, down 140,000, mainly pushed lower by people returning “to work from retirement and caring responsibilities,” Ashley Webb, UK economist at Capital Economics, said.

Cash wages have been growing rapidly for more than a year which, compounded by soaring energy bills, has raised businesses’ costs sharply, amplifying incentives for them to increase prices.

That has alarmed officials at the Bank of England, who are concerned an inflationary feedback loop could be emerging in the UK economy in which workers and firms bid up wages and prices respectively to restore their finances.

Analysts said today’s ONS figures nailed on another interest rate increase by the Bank on 22 June and further such increases.

“Continued strength in pay growth will warrant higher interest rates,” Yael Selfin, chief economist at KPMG UK, said.

“The pickup in regular pay growth is the latest sign that inflation is driving up pay demands, which in turn is making inflation stickier. With negative productivity growth, these figures are well above the levels consistent with the two per cent [inflation] target,” she added.

The Bank has lifted borrowing costs twelve times in a row to 4.5 per cent in a bid to chill the UK economy to bring down inflation. Markets ratcheted up their peak rate banks to 5.7 per cent after this morning’s stronger than expected wage figures.

Soaring wage growth alongside rising core inflation – which leapt to 6.8 per cent from 6.2 per cent over the last month – risks “fanning the impression that the UK has a unique problem with ingrained high inflation,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Britain’s inflation rate is the highest in the G7.

Bank Governor Andrew Bailey and co’s efforts to tamp down on the economy appear to have had little effect on the jobs market yet, with unemployment dropping marginally to 3.8 per cent from 3.9 per cent in the three months to April.

Bailey will be grilled by members on the House of Lords economic affairs committee later today.

The number of people with a job actually reached a record high in the three months to April and is now above pre-pandemic levels, the ONS said.

Vacancies fell 79,000 over the same period to 1.05m, the eleventh month in a row demand for staff has trimmed.