Wage growth hotter than expected but unemployment rises in headache for Bank of England

Wage growth came in hotter than expected, but unemployment picked up, as the labour market offered the Bank of England divergent signals on the impact of its interest rate hikes.

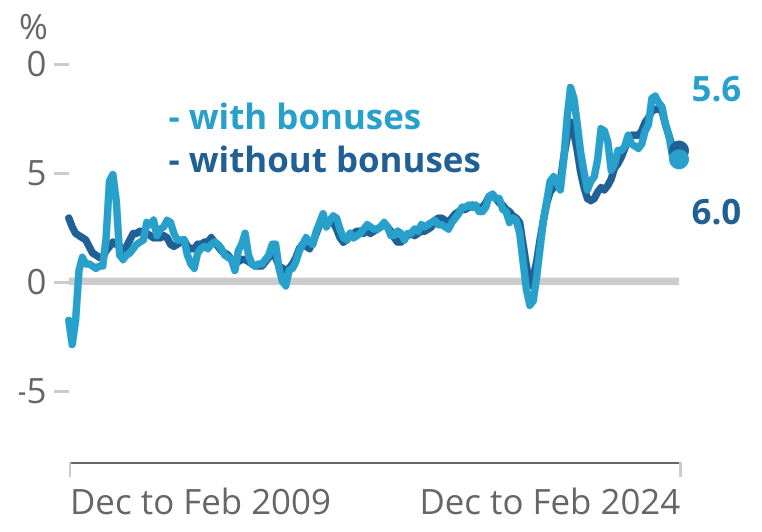

Annual pay growth including bonuses averaged 5.6 per cent between December and February, according to figures from the Office for National Statistics (ONS), unchanged from last month and slightly ahead of expectations.

Excluding bonuses, pay growth eased to six per cent from 6.1 per cent previously. Economists had expected it to fall to 5.8 per cent.

“Recent trends of falling vacancy numbers and slowing earnings growth have continued this month albeit at a reduced pace,” Liz McKeown, director of economic statistics at the ONS said.

Although wage growth is slowing in nominal terms, workers still received their highest pay increase in real terms for two and a half years. Regular annual pay rose by an average of 2.1 per cent over the previous year.

Wages are closely monitored by the Bank of England for signs of how its campaign of interest rate hikes are impacting the wider economy.

Rate-setters are concerned that high levels of wage growth could fuel persistent inflation, particularly in the labour-intensive services sector. Services inflation still stands at over six per cent.

Economists think annual wage growth needs to be closer to three per cent for inflation to remain sustainably at the target.

A Bank of England survey from February showed that finance chiefs at UK firms thought wages would grow around 4.7 per cent in the year ahead, its lowest level since May 2022.

Unemployment meanwhile jumped to 4.2 per cent, higher than the upwardly revised estimate of 4.0 per cent. So far unemployment has remained very low despite the Bank’s rate hikes, something which has surprised many economists.

“The rise in unemployment rate paints a picture of a less tight labour market,” Yael Selfin, chief economist at KPMG UK noted, although McKeown recommended “caution” when interpreting the unemployment figures.

The ONS has faced a growing problem with falling response rates, which has contributed to some volatility in the quarterly figures.

Vacancies fell for the 21st consecutive quarter in another sign of a loosening labour market, but demand for labour still remained above pre-pandemic levels.

“The labour market continues to gradually cool but continued high wage growth underlines concerns over inflation persistence,” Jack Kennedy, senior economist at Indeed said.

Interest rates currently stand at a post-financial crisis high of 5.25 per cent, but the Bank is likely to start cutting rates in the summer.