Vodafone’s Ono takeover marks a new chapter

VODAFONE’S €7.2bn (£6bn) purchase of Spanish cable operator Ono was announced yesterday as the FTSE 100 firm said it has now started a new chapter in its corporate history.

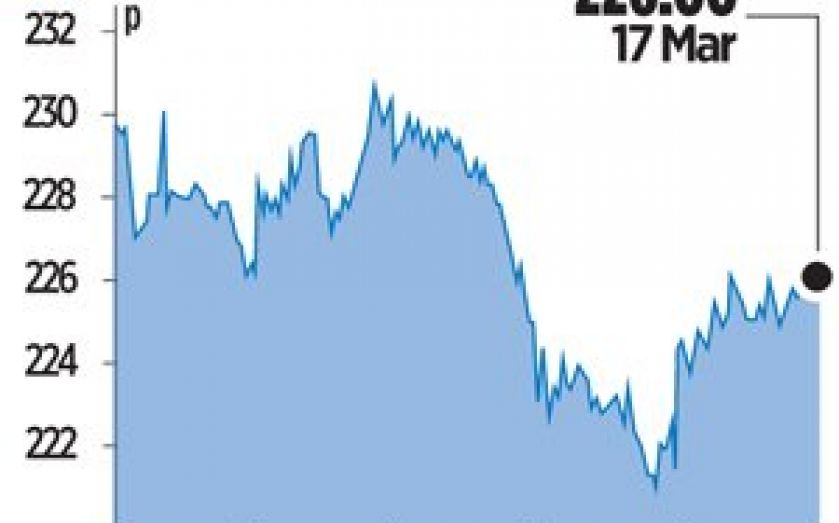

Shares in Vodafone jumped 1.73 per cent on news of the deal which will give Vodafone a stronger position in the Spanish market where it has seen a fall in mobile customer numbers and earnings in recent years.

“We are becoming more and more a unified communications provider…,” said Vodafone’s chief executive Vittorio Colao, speaking after the deal.

Vodafone will bolt Ono’s broadband internet, pay television and fixed services onto its own mobile offering, to become a so-called quad play provider.

“Vodafone is becoming a different company than it was three years ago,” added Colao, referring to the recent acquisitions of Cable & Wireless Worldwide in 2012 and Germany’s Kabel Deutschland in 2013.

Colao stoked hopes that Vodafone is set to become a quad play provider in the UK with a future acquisition, but denied that the company has any interest in buying ITV or Channel 5.

“For the time being the UK is not a quad play market, but we keep engaging in a variety of discussions for potential commercial agreements with others,” said Colao.

The agreement, which comes as the French market undergoes a similar transformation, could also spark more consolidation within Spain as players such as France’s Orange seek out acquisitions to avoid falling behind.

Vodafone’s shares closed at 226.00p yesterday.

VODAFONE’S TAKEOVER OF ONO BY NUMBERS

1 €7.2bn

The total cost Vodafone will pay for Ono using cash and debt to complete the transaction.

2 7.2m homes

Around 41 per cent of homes in Spain use Ono broadband. A further 1.9m take its Pay-TV.

3 £18bn

The total debt Vodafone will hold once it has taken on €3.3bn (£2.7bn) of Ono’s debt.

BEHIND THE DEAL

UBS FOR ONO| CHRISTIAN LESUEUR

1 Lesueur started as a junior analyst at UBS in 2000 working on what is still the largest M&A deal ever, Vodafone’s $183bn (£110bn) takeover of Germany’s Mannesmann in 2000.

2 He has advised Vodafone on 30 transactions since 2000 worth a combined $400bn, and personally advised Vodafone’s current chief executive Vittorio Colao as well as his two predecessors. Lesueur is now EMEA head of technology, media and telecoms at UBS.

3 He is the son of a zookeeper with a truly international upbringing – a French-Danish banker who grew up in Greece, studied at Yale in the US and has lived in London for 15 years.

Also advising…

UBS head of investment banking in Spain, Juan Monte, worked alongside Christian Lesueur advising Ono. Vodafone was advised by Morgan Stanley with a team including Michele Colocci, Jean Abergel and Nuno Machado. Vodafone’s board was also advised by Robertson Robey Associates – the boutique advisory launched last year by City rainmakers Sir Simon Robertson, Simon Robey and Simon Warshaw.