Visa, King and BG Group deals push global M&A over $4 trillion mark for the first time in November

Visa's $23.3bn (£15.2bn) offer for Visa Europe on Monday tipped the volume of global mergers and acquisitions over the $4 trillion mark for 2015 so far – the highest it's ever hit by this point in the year.

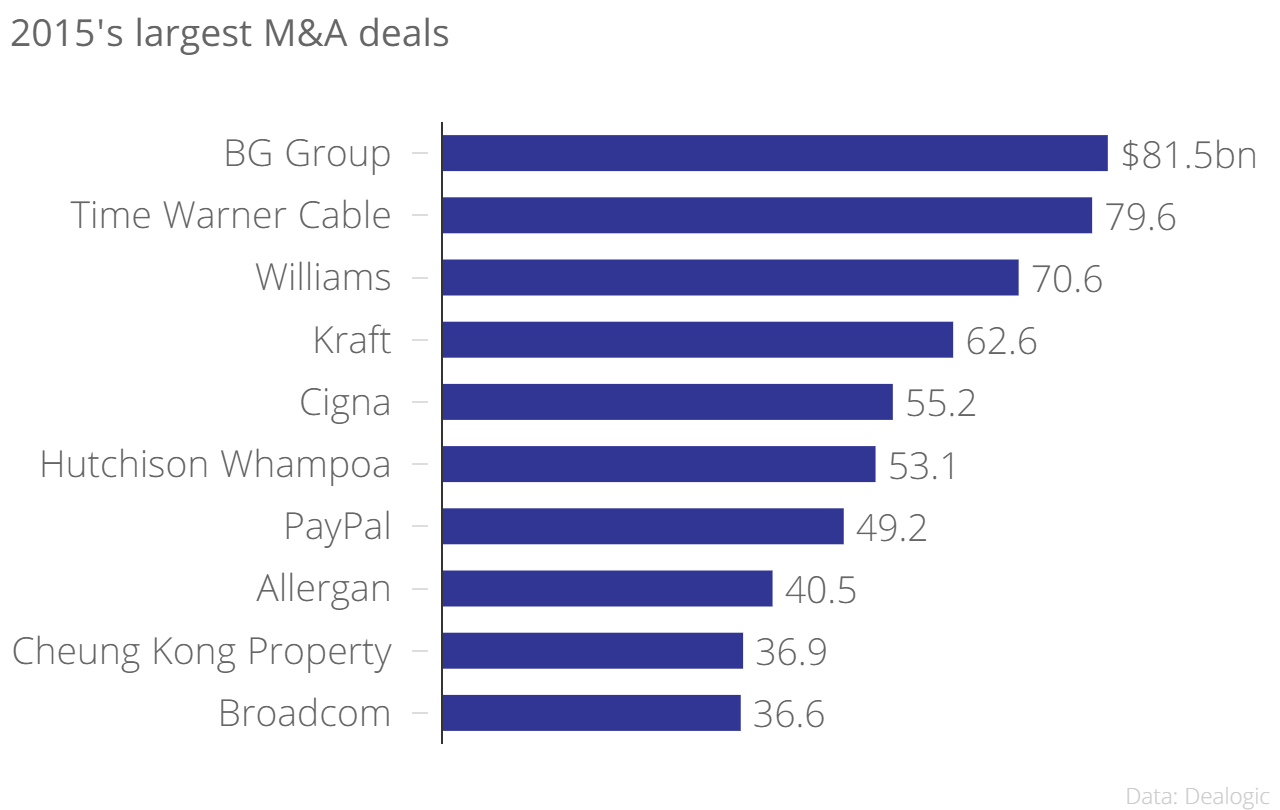

Research by Dealogic showed Visa, along with a gaggle of acquisitive tech and pharma companies, pushed global volumes 38 per cent higher than at the same point last year, and up from $3.9 trillion in 2007, the previous high.

Deals worth $10bn made up 37 per cent of volume – almost double the 21 per cent average over the last five years.

US-targeted deals rose to $1.97tr, 43 per cent higher than the previous record. Meanwhile, Europe-targeted M&A was less impressive, hitting $938.4bn, 40 per cent lower than the 2007 record. In fact, Europe accounted for just 23 per cent of global volume.

US-targeted deals rose to $1.97tr, 43 per cent higher than the previous record. Meanwhile, Europe-targeted M&A was less impressive, hitting $938.4bn, 40 per cent lower than the 2007 record. In fact, Europe accounted for just 23 per cent of global volume.

Technology made up $631.7bn of M&A volume: in recent weeks, gaming giant Activision Blizzard's $5.9bn acquisition of Candy Crush maker King and BT's provisional merger with EE have added to that tally.

Meanwhile, healthcare came second, with a volume of $549.4bn – 14 per cent of the total – thanks, in part, to Shire's $5.9bn offer for Dyax.

Yesterday City A.M. reported that US companies had spent a record $1.8 trillion on mergers and acquisitions this year, as they race to offload huge cash piles before interest rates increase.

US Fed chief Janet Yellen further increased expectations of an impending rate hike today, telling Congress' House Financial Services Committee that a rate hike next month is a "live possibility".