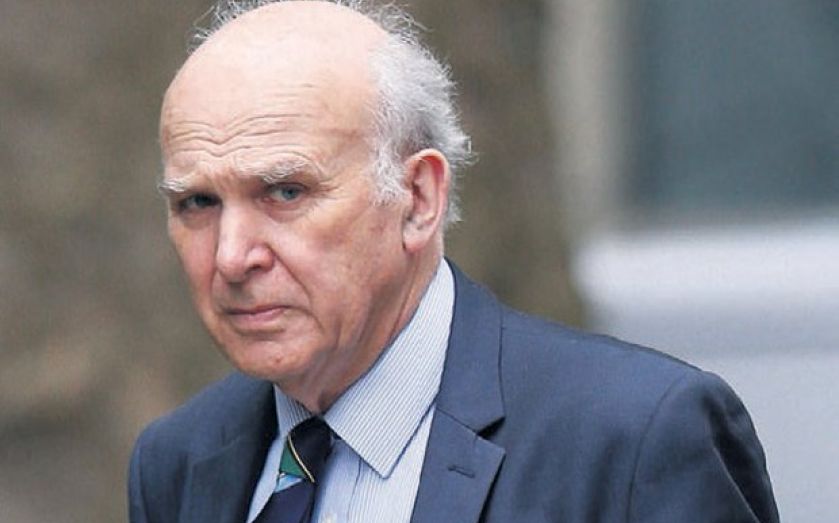

Vince Cable’s plan to guarantee a challenger bank’s business loans

One challenger bank will get a boost from the government when the British Business Bank guarantees its loans to small firms, under a pilot scheme to be launched at the end of October.

It is Vince Cable’s latest plan to increase lending to SMEs, by taking risk away from the bank and on to the government.

He wants the chosen bank to lend to firms which have been turned down by the big banks.

If such firms are given loans the scheme is likely to be deemed a success, and rolled out to more banks.

However, this may also mean the government could end up taking on the riskier loans which the big banks were unwilling to offer.

The deal was announced in the budget, and is now weeks away from being implemented.

Cable had previously pushed for state backed banks RBS and Lloyds to be forced to lend more to SMEs, but met opposition from the chancellor who wanted to rebuild their capital first.

In time, the chancellor did lean on the banks – a factor which in part led to the departure of RBS’ then-boss Stephen Hester in summer 2013.