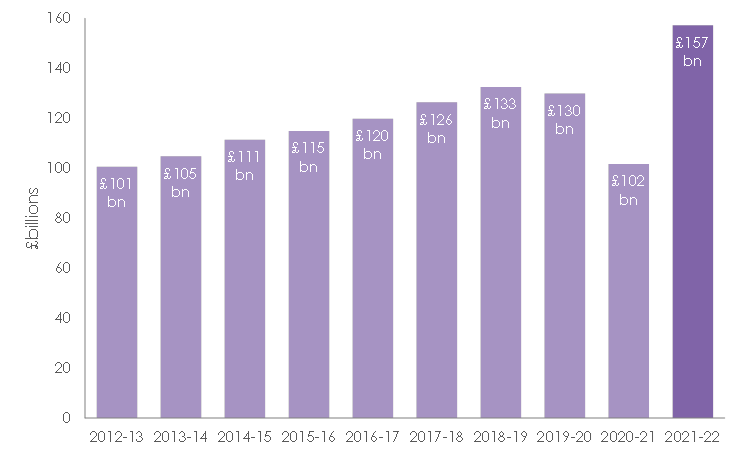

VAT revenues rise to highest amount ever as HMRC pockets £157bn in just one year

HMRC collected a record £157.2bn from VAT bills in in the last tax year, a 55 per cent jump on the £101bn collected in 2020/21, after businesses were forced to make up for VAT payments they deferred during the pandemic.

Accountants have told City A.M. that HMRC’s VAT income has risen sharply after the rate of VAT paid by the hospitality sector increase to 20 per cent on 31 March last year.

The rate was temporarily reduced to 5 per cent during the pandemic to ease the burden on pubs, restaurants and hotels forced to close during lockdown.

Additionally, the Government introduced a VAT holiday between March and June 2020 to support businesses hit hard in the early stages of the pandemic.

VAT bills in the last decade

The holiday was later made more generous, allowing many businesses to defer their VAT payments into smaller instalments until March 2022.

Sean Glancy, a partner at accountancy group UHY Hacker, explained to City A.M. that sharply rising inflation has also played a role in driving up the amount HMRC collects in VAT.

“For all the good the VAT holiday did at the time it was introduced, it’s resulted in businesses paying the most VAT in recorded history the year after,” Glancy said.

“The VAT holiday saved a lot of businesses in 2020 but it effectively just pushed the bills from one year into the next. Those increased payments in 2021 hurt for some of them.”

“If inflation continues to run out of control the amount paid in VAT is only going to rise. Cutting VAT temporarily is one option the Government has to ease the cost of living crisis for individuals and businesses,” Glancy concluded.