US stock markets plummet amid coronavirus sell-off

US stock markets have plunged as investors scramble to sell-off global equities amid new fears over the coronavirus, which has spread rapidly in Italy, South Korea and Iran.

The Dow Jones index plummeted 2.9 per cent after the bell, shedding 830 points. The tech-heavy Nasdaq tumbled 3.4 per cent, while the S&P 500 dropped 2.8 per cent.

In Europe, Britain’s FTSE 100 was down 3.6 per cent as it approached the end of the day. Germany’s Dax was four per cent lower and France’s CAC 40 had also shed four per cent.

Cases of coronavirus have risen rapidly in various countries around the world in recent days. This is despite the World Health Organization (WHO) saying the spread of the virus has slowed in China, where it originated.

Italy, which has seen Europe’s biggest outbreak, has suffered some 150 infections and seven deaths. The government has sealed off the worst-affected towns and outlawed public gatherings, halting Venice’s annual carnival.

Iran said it has now had 61 cases and 12 deaths, while Bahrain and Iraq have also reported their first cases. The number of cases in South Korea jumped by 231 in recent days, taking the total to 833.

Guy Foster, head of research at investment manager Brewin Dolphin, said: “The sanguine attitude of markets towards the coronavirus had partly relied upon the remarkable containment of cases within a relatively small region of China.

“That pillar of support wobbled a little with the news of more cases in Korea and Italy and investors reacted accordingly.”

John Redwood, chief global strategist for broker Charles Stanley, said investors are asking themselves “taxing questions about how much output and income China is now losing this quarter”.

He said they are also worried about the global impact of “falling international travel, reduced high-end luxury purchases, fewer trips to shops, entertainment and conference venues, less oil demand and the other signs of consumer worry”.

As they sold off stocks, investors bought up so-called safe-haven assets such as the Japanese yen and US government bonds.

The yen jumped 0.9 per cent against the dollar so that one dollar bought ¥110.57.

The yield on the 10-year US Treasury bond fell 11 basis points (0.11 percentage points) to 1.367 per cent. Yields move inversely to price.

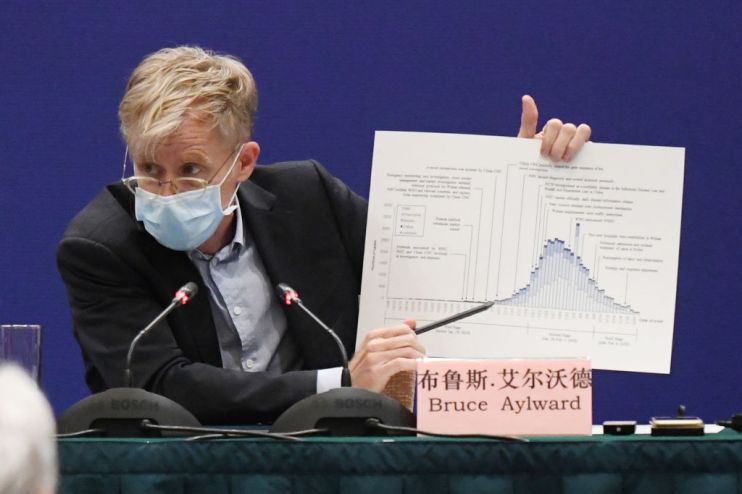

The head of the WHO delegation in China, Bruce Aylward, today said that things would have been worse without China’s fast and dramatic response to the coronavirus outbreak.

He said multiple sources of data suggested the number of cases was slowing in China, where the virus has infected almost 77,000 people and killed more than 2,500.

Superstar investor Warren Buffet said the outbreak was “scary stuff” but he would not be selling stocks.

Speaking to US news channel CNBC, the so-called Sage of Omaha said: “I don’t think it should affect what you do in stocks.” He said investors should take a long-term view, and realise they will get “more for your money in stocks than bonds”.