US seeks $4bn from Binance to end criminal probe

The U.S. Justice Department is seeking more than $4 billion from Binance Holdings as part of a proposed resolution of a years-long investigation, Bloomberg News reported on Monday, citing people familiar with the discussions.

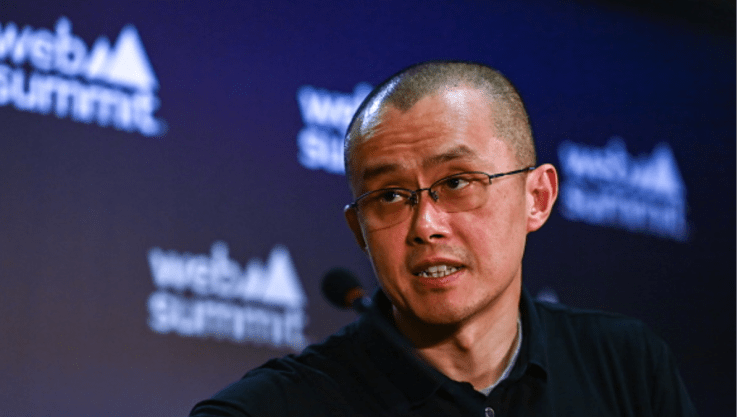

Negotiations between the Justice Department and Binance include the possibility that the cryptocurrency exchange’s founder, Changpeng Zhao, would face criminal charges in the United States, the report said.

Any resolution is likely to play a crucial role in investor sentiment toward crypto, which has taken a hit over a wave of government investigations and charges against firms and individuals in the industry, including the recent fraud conviction of FTX founder Sam Bankman-Fried.

The industry also was shaken by several high-profile collapses last year, but is looking to regain some footing after getting a vote of confidence from some traditional financial institutions.

A source familiar with the investigation said the long-running government probe was nearing conclusion, but did not give specific information on penalties or exact timeline. The Bloomberg report said an announcement on the resolution could come as soon as the end of this month.

Binance did not immediately respond to a Reuters request for comment. A spokesperson for the Justice Department declined to comment.

Binance has been under Justice Department’s scrutiny since at least 2018, Reuters reported last year. Federal prosecutors asked the company in December 2020 to provide internal records about its anti-money laundering efforts, along with communications involving Zhao, Reuters has reported.

The DOJ probe is one of a string of legal and regulatory headaches the world’s biggest crypto exchange faces in the United States.

In June, the Securities and Exchange Commission (SEC) sued Binance and Zhao, accusing them of operating an “elaborate scheme to evade U.S. federal securities laws.”

Binance denied the SEC’s allegations and said it would “vigorously defend” its platform.

The Commodity Futures Trading Commission also sued the exchange in March for “willful evasion” of U.S. commodities law, alleging that Binance and Zhao operated an “illegal” exchange and a “sham” compliance program.

Zhao called those charges an “incomplete recitation of the facts.”

With crypto markets subdued compared with the highs of 2021, Binance has also witnessed an executive exodus and slumping market share.

At least a dozen executives have left the exchange in recent months, including Binance’s chief strategy officer, general counsel and chief product officer.

Reuters – by Niket Nishant and Tom Wilson