US markets shake off Delta variant jitters as investors seek to end volatile week on a high

Wall Street shook off concerns that the rapidly spreading Delta variant of Covid could halt the global economic recovery from the crisis to end the week on a high.

The blue-chip S&P 500 jumped 0.69 per cent to 4,436.26 points during early trading, while the Dow Jones added 0.5 per cent to 35,06776 points.

The S&P 500 was on track to record its worst week in two months at the start of the day, but mid-morning gains turned the tide. The tech-heavy Nasdaq climbed 0.95 per cent to 14,679.79.

Yields on 10-year Treasuries hovered around 1.25 per cent in early trading.

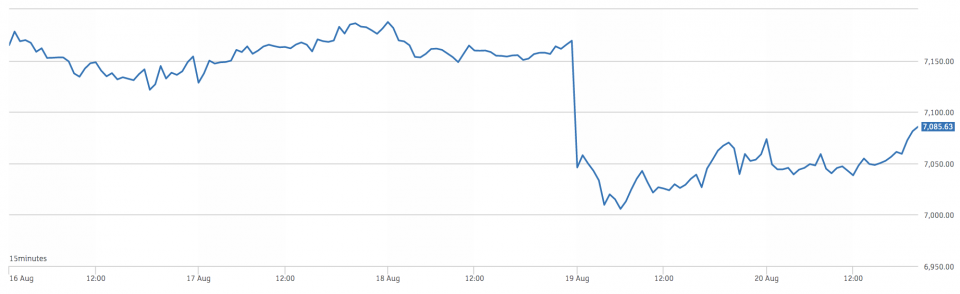

FTSE 100 recovers losses but set to end week in the red

London’s FTSE 100 pared back losses registered yesterday but was on track to end the week in the red.

The capital’s premier index jumped 0.31 per cent to 7,082.52 points during mid-afternoon trading today.

The blue-chip index was on track to register its worst week since January after suffered losses in early morning trading.

Poor retail sales figures released by the Office for National Statistics this morning fed into concerns that the economic rebound from the depths of the Covid crisis may be losing steam. Sales dropped 2.5 per cent between June and July of this year.

Meanwhile, the ONS said government borrowing had come in much lower than official forecasts published by the Office for Budget Responsibility in July. The government borrowed £10.4bn in the month, down £10.1bn in the same month last year, highlighting that the spectre of the Covid crisis over the economy is receding.

Danni Hewson, financial analyst at AJ Bell, said: “Markets may struggle for direction until the latter part of next week given a dearth of corporate and economic updates with the Jackson Hole summit kicking off next Thursday and giving central bankers and other economic decision makers a chance to outline their plans for the next phase of the pandemic recovery.”

The mid-cap FTSE 250 surged 0.71 per cent to 23,773.41 points, while AIM shares rose 0.09 to 1,261.97 points.

The pound lost ground on the dollar, weakening 0.18 per cent to $1.3615.

Winners and losers

Despite a decline in retail sales, retail stocks led the table of the biggest risers on the FTSE during morning trading.

JD Sports was the best performer on the blue-chip index, climbing 3.46 per cent to 1,002.50p, while B&Q parent company Kingfisher added 2.03 per cent to reach 361.90p.

Brewer Diageo was the worst performer on the FTSE, dipping 1.47 per cent to 3,514.50p, while British Airways parent company IAG slipped 1.35 per cent to 157.66p.