US inflation shock may force Fed to launch one percentage point rate hike

A scorching set of new US inflation numbers released tomorrow could force the Federal Reserve to hike interest rates by the steepest amount in recent history, Wall Street analysts are betting.

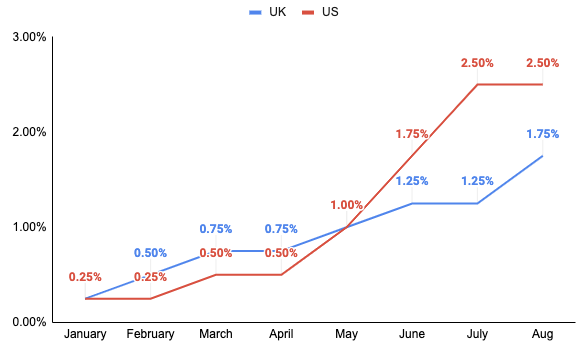

Fed chief Jerome Powell and co have already had to hike the world’s most important interest rate by 225 basis points since March, the fastest tightening cycle since the early 1980s, to tame rising prices.

An upside shock in tomorrow’s inflation figures may seal the deal for a jumbo-sized move.

“We would not be too surprised by a 100 basis point hike if core inflation comes in stronger than expected,” analysts at investment bank Citi said. The bank’s base case is a 75 basis point lift.

The Fed has never raised borrowing costs by a full percentage point since it started announcing moves in its key interest rate in 1994.

US and UK interest rates

The central bank has already breached convention by lifting them 75 basis points two months in a row. US rates now stand between 2.25-2.5 per cent.

Wall Street expects consumer price index (CPI) inflation to have eased from a 40-year high of 9.1 per cent in June to 8.8 per cent last month.

A reduction in petrol and energy prices likely dragged headline inflation down.

But, core inflation, often characterised as a more accurate measure of underlying price pressures, may remain elevated, analysts said.

“We believe the core CPI rose 0.5 per cent in July… This would be a solid gain,” JP Morgan said.

Despite edging lower, price pressures are likely to “remain uncomfortably hot for Fed officials,” analysts at investment firm PIMCO said.

Central banks have been forced to switch off ultra-stimulative policy that has propped up the global economy since the financial crisis to tame the biggest inflation surge in four decades.

Last week, the Bank of England hoisted borrowing costs 50 basis points for the first time in its 25 years of independence to 1.75 per cent, a 14-year high.

Governor Andrew Bailey and the rest of the monetary policy committee justified the move to get ahead of what they think will be a more than 13 per cent inflation peak.

The Bank is raising rates despite warning Britain is set to tip into the longest recession since the financial crisis. Central banks typically loosen policy during downturns to support businesses and households.

On the Continent, the European Central Bank last month marked its first rate rise in over a decade with a shock 50 basis point move.