US inflation cools quicker than expected in sign Fed’s rate hikes are quashing prices

US inflation is cooling much quicker than experts are betting in a sign the Federal Reserve’s series of steep rate hikes are quashing price pressures.

Prices climbed 8.5 per cent annually in the world’s biggest economy last month, down from a 40-year high of 9.1 per cent, the US Labor Department said today.

Wall Street had expected headline consumer price index inflation to have dipped to 8.7 per cent in July.

The fresh figures are likely to dial down calls for another super-sized rate hike from the Fed, analysts said.

“This report will no doubt be a welcome relief [for the Fed], but we still assign a relatively high probability to them hiking another 75 basis points in September,” analysts at investment firm PIMCO said.

Analysts had warned Fed chief Jerome Powell and the rest of the federal open market committee may hoist rates a whole percentage point at its next meeting on 21 September if today’s figures produced an upside shock, something they have not done since announcing rate moves in 1994.

They have already embarked on the quickest rate hike cycle since the early 1980s to tackle an inflation surge.

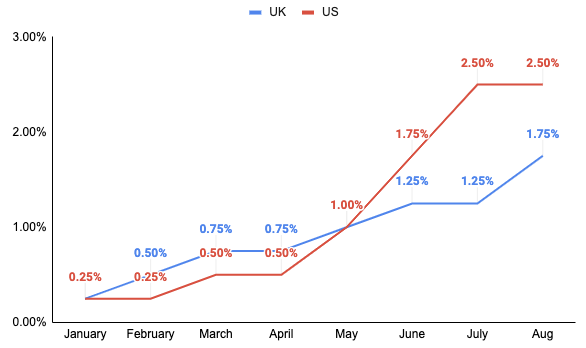

US borrowing climbs have climbed 225 basis points since March, including two successive 75 basis point rate hikes.

The return of soaring inflation has forced the Fed to breach recent monetary policy convention. Rates have been ultra-low since the financial crisis.

A sharp reduction in petrol prices pushed overall inflation beneath expectations.

A tight jobs market has raised wages, prompting US firms to hike prices and adding to inflation. The US unexpectedly added 528,000 last month, pushing the unemployment rate down to 3.5 per cent.

The Fed is raising rates to curb spending and cool worker demand which should, in theory, tame price pressures.

However, those rises, in addition to US consumers’ being squeezed by higher prices, has resulted in the economy contracting for two successive quarters, often seen as a sign of the start of a recession.

UK and US interest rates

Core inflation, which strips out products that are subjected to wild price swings and seen as a more accurate measure of price pressures, also dipped below Wall Street forecasts, sticking at 5.9 per cent in July.

The world’s biggest central banks have switched off ultra-stimulative policy that has propped up the global economy since the banking crisis in 2008 due to inflation surging high above their respective targets.

The Bank of England last week lifted borrowing costs 50 basis points for the first time in nearly 30 years, taking them to 1.75 per cent, a 14 year high.

On the Continent, the European Central Bank (ECB) last month marked its first rate hike in more than a decade with a shock 50 basis point move.

Inflation in the UK and eurozone is running 9.4 per cent and 8.9 per cent respectively, both historic highs, both far above the Bank and ECB’s two per cent targets.