Markets cheer US inflation slowdown as Nasdaq flies over five per cent

Global markets have cheered signs that US inflation is falling much faster than experts expected, dialling down pressure on the Federal Reserve to keep hiking interest rates aggressively.

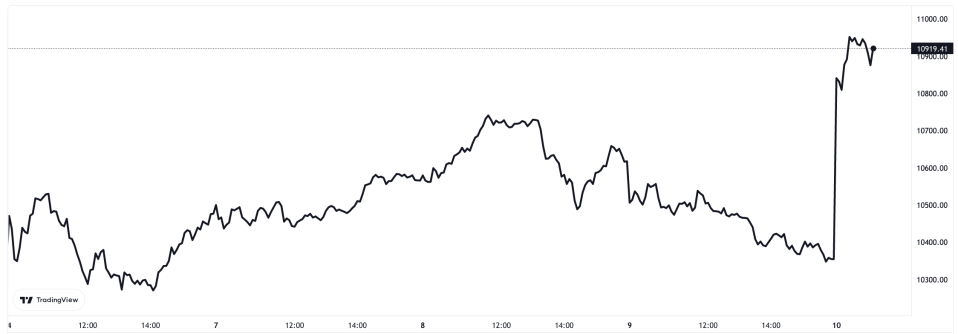

Wall Street’s tech-heavy Nasdaq index flew more than five per cent, while the S&P 500 and Dow Jones shot up more than four per cent and nearly three per cent respectively.

The US dollar tumbled against the world’s biggest currencies. The pound strengthened 2.68 per cent against the greenback.

London’s FTSE 100 climbed higher after the figures were released, while the domestically-focused mid-cap FTSE 250 soared 2.2 per cent.

Prices across the pond, prices climbed 0.4 per cent over the last month, lower than Wall Street’s expectations, but still the same as September’s rate, the US Labor Department said.

Economists have zeroed in on the monthly inflation measure to assess whether the Fed’s campaign to tame prices is working.

Core inflation, which has emerged as the most accurate gauge of whether underlying price pressures in the world’s largest economy are easing, dropped to 0.3 per cent from 0.6 per cent, also below analysts’ expectations.

Nasdaq jumped more than five per after US inflation figures shocked to the downside

On an annual basis, inflation hit 7.7 per cent, down from 8.2 per cent.

Fed chair Jerome Powell has overseen the quickest monetary policy tightening cycle this year since the early 1980s.

Last week, the world’s most influential central bank kicked borrowing costs 75 basis points higher for the fourth time in a row, taking its cumulative rate hike cycle to 375 basis points since March.

Investors were hoping Powell would signal a slowdown in rate rises, known as the “Fed pivot”.

The federal open market committee’s statement seemed to signal that was coming, but Powell, in a press conference after the statement was published, said US interest rates would eventually peak higher than expected, albeit the journey to that peak would be slower.

Today’s figures likely mark “the start of a much longer disinflationary trend that we think will convince the Fed to halt its tightening cycle early next year, with the policy rate peaking at 4.5 per cent to 4.75 per cent, and to begin cutting rates again before the end of 2023,” Paul Ashworth, chief north America economist at Capital Economics, said.

Markets reckon there is an 80 per cent chance the Fed will raise rates 50 basis points at its next meeting on 14 December.

The Fed has been trying to chill consumer and business spending by making it more expensive to borrow which should, in theory, curb price rises.

Inflation across the west has returned viciously after years of low and steady price growth.

Rapid price increases have forced the world’s top monetary authorities to ditch ultra-low interest rates and bond buying, programmes which propped up the global economy since the financial crisis and during the Covid-19 pandemic.

Pound/US dollar exchange rate

The Bank of England last week signed off a 75 basis point rise, the biggest rate hike in over 30 years, taking borrowing costs to three per cent, the highest since November 2008.

The European Central Bank has lifted rates 75 basis points twice in a row, marking a big shift in its policy strategy.

President Christine Lagarde and co launched their first rate bump since 2011 and took borrowing costs out of negative territory, where they had been since 2014.

Prices in the UK and eurozone are up 10.1 per cent and 10.7 per cent over the last year respectively.