US existing home sales increase at fastest rate in three years

More homes than expected were sold in the US in July, according to data from the National Association of Realtors (NAR) (release).

Existing home sales – which are completed transactions including single-family homes, townhomes, condominiums and co-ops – rose to a seasonally adjusted annual rate of 5.39m in July – up from a downwardly revised 5.06m the month before. Analysts had expected to see an increase to 5.10m.

Compared to July 2012, existing home sales have jumped 17.2 per cent – the biggest annual increase in three years.

Paul Diggle, property economist at Capital Economics, said the increase in home sales was probably due to buyers rushing through home sales before mortgage rates rise.

If this is behind the increase in home sales, it will be a temporary stimulus – sales will have just been pulled forward from August.

Abstracting from this month-by-month volatility, however, the bigger picture is that existing sales are back around normal levels and will creep up only slowly from here.

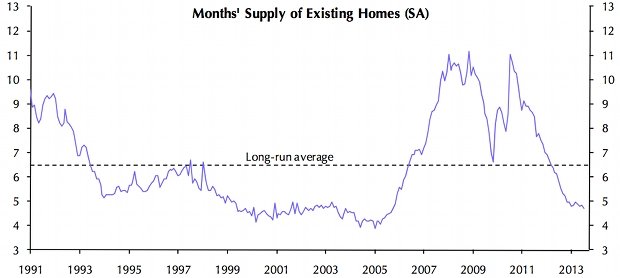

For question around future house price movements, the most important aspect of the existing home sales report is the inventory numbers. Existing homes for sale increased by 5.6% m/m in the headline figures in July, and by 3.7% m/m after seasonal adjustment. Since reaching a trough in January, the number of existing homes for sale has risen by 29%. Moreover, this is more than just the usual seasonal rise in inventory – after seasonal adjustment, inventory is 7% higher than at the start of the year.

Rising house prices and improving selling conditions are behind the increase in inventory. Although the higher sales rate saw the months’ supply of unsold stock tick lower in July, the bigger picture is that it is bottoming out. That’s consistent with the pace of house price inflation levelling off soon.

Capital Economics

Lawrence Yun, chief economist at NAR, said changes in affordability are affecting the market.

Mortgage interest rates are at the highest level in two years, pushing some buyers off the sidelines. The initial rise in interest rates provided strong incentive for closing deals. However, further rate increases will diminish the pool of eligible buyers.

Although housing affordability conditions will become less attractive, jobs are being added to the economy, and mortgage underwriting standards should normalize over time from current stringent conditions as default rates fall.