US executive to leave Softbank’s $100bn Vision Fund

A top US executive is leaving Softbank’s $100bn Vision Fund after expressing concerns about “issues” at the Japanese investment giant, which has been hit by a series of setbacks over the past few months.

Michael Ronen, a former banker at Goldman Sachs who joined Softbank in 2017, told the Financial Times he was leaving and had been “negotiating the terms of my anticipated departure” for several weeks.

Ronen had been a managing partner of the Vision Fund’s US investments, and oversaw many of its bets on transport startups including Getaround and Flexport.

The paper also reported that the Vision Fund was in talks with long-time executive Ron Fisher about his future at the company.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

The company told the FT that Fisher was “a valued member of the Softbank family” and was “not going anywhere”.

One of the world’s biggest tech investors, Softbank has come under pressure following the botched listing attempt by office-sharing firm Wework late last year.

Softbank had made over $10bn investments in Wework, and took control of the startup with a $9.5bn rescue package after it pulled its planned initial public offering.

The soured bets on Wework and other tech prospects including Uber helped drag Softbank to its first quarterly loss in 14 years in November.

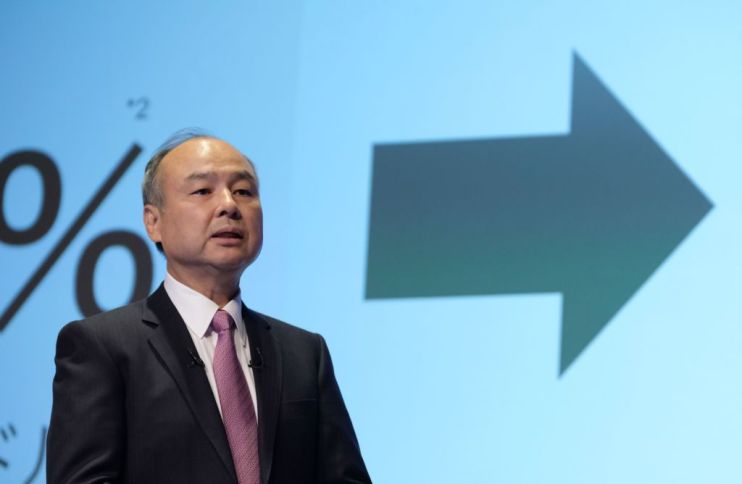

The tech investor had been planning to launch its second Vision Fund, but has been unable to secure the $108bn founder Masayoshi Son said had been committed in July.

It is understood that many prospective investors in the fund are yet to firm up their non-binding commitments amid concerns over Softbank’s string of disappointing bets.

City A.M. has contacted Softbank for comment.