US economy adds more jobs than expected in headache for Fed

The US economy added more jobs than expected last month, but cooling wage growth may convince the Federal Reserve to hold off on repeating jumbo interest rate hikes this year, official figures out today reveal.

Some 223k Americans bagged a new job last month, down slightly from November, according to data from the US Bureau of Labor Statistics.

The figures were higher than Wall Street’s estimates of a further 202k added to the US economy.

However, pay growth stemmed to 4.6 per cent over the year, lower than a five per cent consensus forecast and November’s 5.1 per cent increase.

The rise in employment volumes sent the American unemployment rate down to 3.5 per cent, also beating traders’ bets and down from the last set of numbers.

Why it’s a headache for the Fed

The data presents a headache for Fed chair Jerome Powell and the rest of the federal open market committee (FOMC).

It has since swung backwards to just over seven per cent, prompting experts to bet it has passed its peak and will fall throughout 2023.

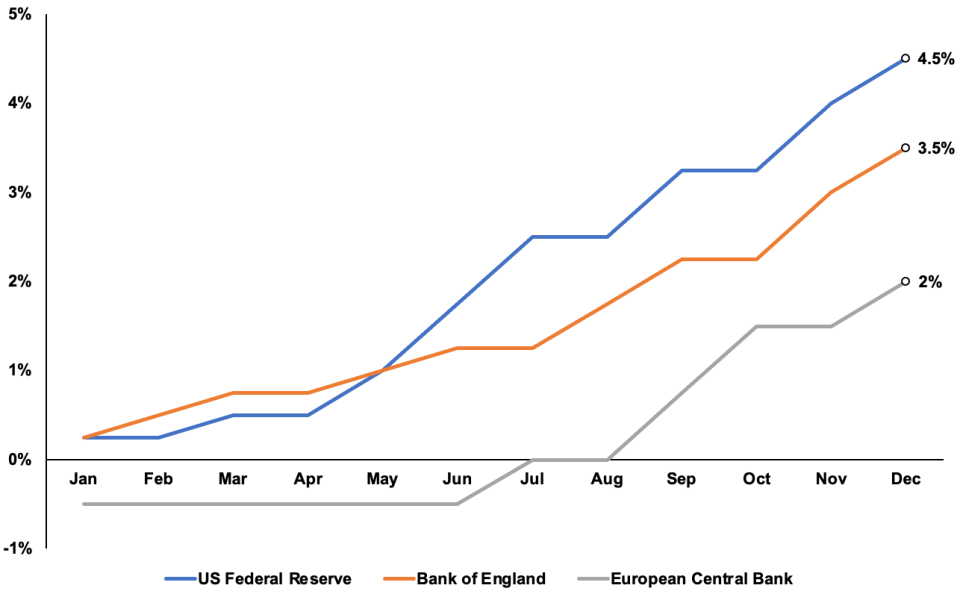

Powell and co lifted borrowing costs at the fastest pace since the 1980s last year, including four back-to-back 75 basis point increases, sending them from near zero to a range of 4.25 per cent and 4.5 per cent between March and December.

Policy makers are worried they could retain too much strength in the jobs market if they ease off tightening financial conditions. That risks keeping inflation high by protecting demand.

But, they are also trying to avoid heaping unnecessary pressure on the US economy by making it more costly for households and businesses to borrow.

Central banks have lifted rates rapidly

Tweaks to monetary policy tend to take months to feed through to the real economy, meaning central bankers fly blind when setting interest rates.

With the rate of price rises now seemingly falling, the Fed may tip the economy into recession and actually push inflation below their target if they tighten too severely.

Will rates be hiked again – and by how much?

Markets now think a 25 basis point jump is the most likely course of action at the Fed’s next meeting on 1 February and further hikes could be a fixture throughout the year.

“The data are a mixed bag for the Fed and will probably keep it hiking at the next couple of meetings. But we continue to expect weaker labour market conditions to push wage growth even lower soon, helping to reinforce the downward trend in core inflation already underway,” Andrew Hunter, senior US economist at consultancy Capital Economics, said.

Wall Street’s top indexes – the S&P Global, Dow Jones and tech-heavy Nasdaq – were up in pre-market trading.

Minutes from the Fed’s December meeting released earlier this week revealed the FOMC is uneasy with financial markets betting the central bank will respond to recessionary signals by taking its foot off the rate accelerator.

Like other monetary authorities’ official interest rate, the federal funds rate slows the economy by prompting investors to demand a higher rate of return on treasuries, the equivalent to UK gilts.

The increase in government yields mainly triggers banks to raise the amount they charge on loans which, in theory, should sap demand.

Yields on the 10-year treasury edged lower on the news, Yields and prices move inversely.