US Data in Focus as we begin 2023

Back again for another year of trading and our focus immediately shifts to the world’s largest economy in the midst of the impending global recession that we are looking at heading into the rest of 2023.

As manufacturing has showed a continuing slowdown this week we turn our attention to the first non-farm payrolls release of the year today, and then to another CPI print next week, which will hopefully give us a further slowdown in inflation, and signal that the rate hikes can in fact stop.

The number of jobs added to the economy in December continued to decrease, to the lowest amount since December 2020. However, the Unemployment rate has declined back to its Pre-Pandemic low of 3.5% and average hourly earnings have decreased as well. The report also suggests that hiring is slowing as well although it does remain strong in relative terms. With the FED saying that the unemployment rate is due to rise to 4.6% at some point this year, my worries would be that the unemployment rate coming down here could be a seasonality factor at play, with temporary jobs being added in the lead up to Christmas as the average earnings are down, which could mean there is pain ahead in the jobs sector heading forward, and it will be interesting to see how the next release affects markets next month.

The initial reaction to this report was short Dollars and long stocks, however at the time of writing these moves are retracing, which is a normal reaction but as we head towards the close this evening it will be interesting to see how markets finish up, and what sort of reaction plays out over the course of the US session. My thoughts on this at the moment would be that markets feel that with a strong labour market, a recession is not yet here, and with analysts predicting an uptick in unemployment, a slight miss is showing that the longer the labour market can remain strong, the shallower this recession may be. A little bit hard to read into right now I feel but again, better trading may come when we can digest it properly.

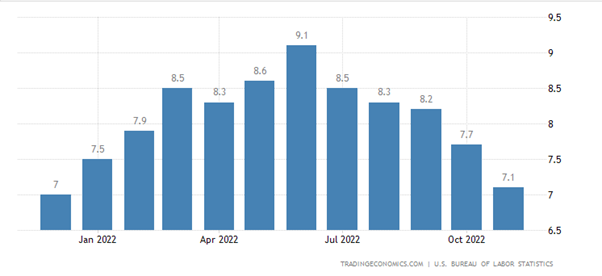

This jobs report does not really suggest we are currently in a recession, with the labour market remaining strong, our eyes then turn to the CPI print on Thursday of next week. The total rate of inflation has been pulling back for a number of months.

As seen above, since the peak in June of last year we’ve managed to claw back a full 2% but there is clearly a lot more to be done on this side if we are to get it back to a realistic number. The attention was then on the Core CPI, which excludes food and fuel prices, as that had been continuing higher in the midst of lower fuel prices.

What we can see here then is a peak of 6.6% back in September and now a 0.6% drop since then. January’s print for December is to show a number below 6%. With inflation still cooling off it shows that the idea of stopping the hiking cycle is still justified and the central bank can go on hold, and let the cooldown play out, without crippling the economy further than it already may be. The idea for next week still seems to be short Dollars and long stocks off the back of a weak print. However long that lasts though is anyone’s guess, as inevitably the financial reporting will turn back to stories about a recession soon after. It is important to remain flexible in the medium term, but in my opinion a weak print next week can give us some short term trading opportunities, which we will definitely try to take advantage of.

How to Learn to Trade on Financial Markets?

It’s essential to ensure you have the right skills and knowledge to capitalise on the opportunities presented from a recession and studying a trading course at an accredited, award-winning academy can help provide you with an advantage. The London Academy of Trading has a combination of practical application and theory that can provide you with the skills to thrive in financial markets, whilst their 10h/day support can help provide immediate help and advice.