US bank stocks fall to record low against S&P 500 as sector hurts from bond crash

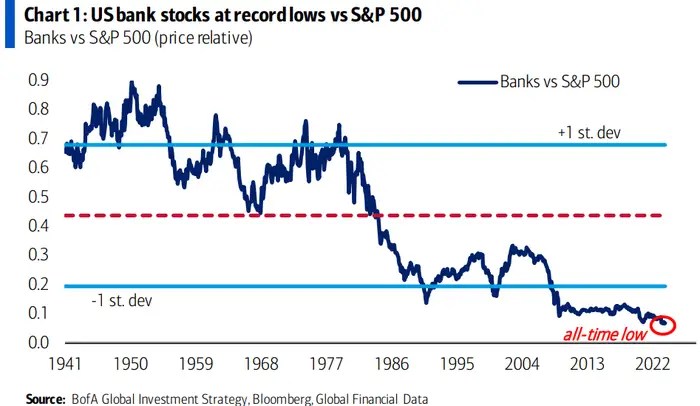

US bank stocks have plunged to an all-time low relative to the S&P 500 index as lenders continue to feel the impact of the banking crisis that erupted earlier this year.

On Tuesday last week the S&P’s banking sector’s relative performance compared with the blue-chip benchmark hit its weakest since the industry-specific measure started in 1989, according to analysis by Bank of America.

The broker added that the stocks were also at an all-time low compared with a precursor to the S&P banks index that began in 1941.

Banks’ government-issued treasury bonds have experienced a crash since the Covid-19 pandemic, driven by rising interest rates and signs of weakness in the US economy.

The bond crash triggered the rapid collapse of lenders First Republic, Silicon Valley Bank and Signature Bank in March, which rocked the wider sector.

The higher-for-longer climate for interest rates has added further pressure to lenders’ bond portfolios as they rack up larger unrealised losses, meaning banks have less capital at their disposal if they need to sell assets.

The S&P banks index has dropped some 12 per cent so far this year, compared with a 13 per cent rise for the wider benchmark.

Bank of America said any improvement in the subindex’s relative performance could mark a shift towards value investing.

The bank noted that the sector had been weakened in the long term by factors including debt crises in the 1980s, 1990s and 2000s, as well as increased regulation.

“The underperformance of banks in the past 10 years has been driven by historically low interest rates, poor balance sheets and government regulations hampering bank profitability,” Bank of America investment strategist Michael Hartnett said in a recent note.

“Higher-for-longer interest rates, weaker loan demand and growing regulation add to the expectation that credit costs are heading higher in coming quarters. Operating costs also share broad inflation pressures,” Bloomberg Intelligence analyst Alison Williams told City A.M.

Wall Street has warned that further regulation under the Basel III capital rules risks making bank stocks even less attractive to investors.