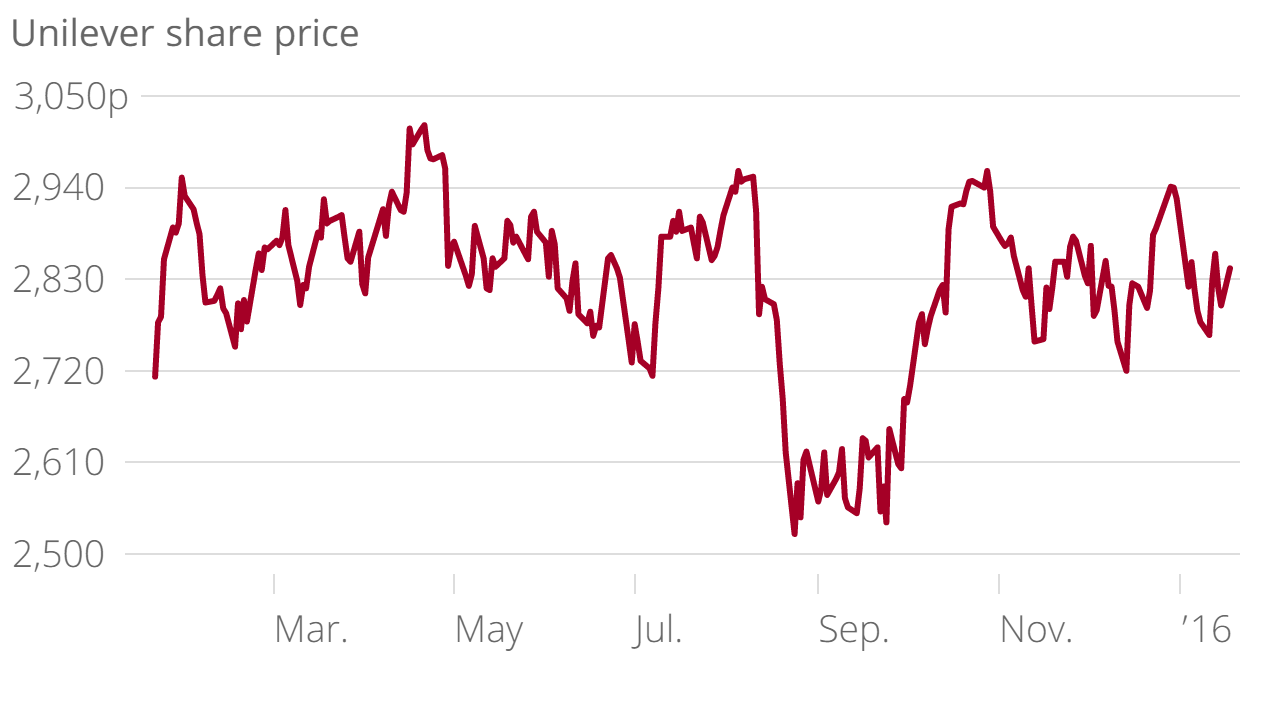

Unilever warns of “tougher market conditions” in 2016 despite smashing sales expectations

Battling currency headwinds and slowing global growth, consumer goods giant Unilever has warned of “high volatility” and tougher conditions in the year to come, despite posting underlying sales growth that beat expectations.

The figures

The FTSE-listed consumer goods firm posted underlying sales growth of 4.9 per cent for the last three months of 2015, a slowdown from the previous quarter’s 5.7 per cent growth, but still ahead of analysts’ forecasts of four per cent.

Unilever reported a full-year turnover of €53.3bn (£40.6bn), up 10 per cent against 2014.

Net profits dipped five per cent to €5.3bn, while operating profits fell six per cent to €7.5bn.

Diluted earnings per share were down four per cent to €1.72.

Why it’s interesting

Unilever warned that 2015 would be a tricky year right from the start, but despite this the consumer goods giant has delivered solid results.

When it missed sales expectations last year, chief executive Paul Polman said it didn’t plan on a “significant improvement in market conditions” over 2015.

Since then, however, Unilever has smashed sales expectations for four consecutive quarters – and emerging markets are keeping it afloat. Globally, underlying sales growth landed at 4.1 per cent for 2015, against 7.1 per cent in emerging markets.

But the firm remains cautious for the year to come, warning of “tougher market conditions” in 2016.

What they said

Paul Polman, chief executive, said:

We are preparing ourselves for tougher market conditions and high volatility in 2016, as world events in recent weeks have highlighted. Therefore it is vital that we drive agility and cost discipline across our business.

We are further strengthening our innovation funnel while shortening innovation cycle times, stepping up our digital capabilities and rolling out a global zero based budgeting programme.

Our priorities continue to be volume-driven growth ahead of our markets, steady improvement in core operating margin and strong cash flow.