Umbria Network reveals fast and inexpensive cross-chain bridging for crypto assets

Polygon, Binance Smart Chain, Avalanche, Fantom, RONIN, Solana, Cardano – these are just a few of the thousands of blockchain networks available that offer a particular edge over the Ethereum mainnet for participating in DeFi and NFT platforms.

Whilst an array of chains with varying functionality and use cases seems like the decentralised dream, the problem is they’ve been existing in relative isolation with poor interoperability. Though this has changed to a degree in recent times, the cost of ‘bridging’ – sending digital assets from one network to another – in order to take advantage of these destination networks’ faster speeds and cheaper transactions has been prohibitively expensive and time-consuming as well as technically difficult.

Umbria has developed a new style of bridge, which offers a much faster and low cost solution to the traditional validator-driven bridging model and removes the encumbrances. It uses a novel liquidity-provision protocol, which facilitates cross-chain migration of assets by holding multiple assets on multiple chains simultaneously in liquidity pools. This enables users to move crypto from Ethereum to other EVM- compatible blockchains very quickly and cheaply.

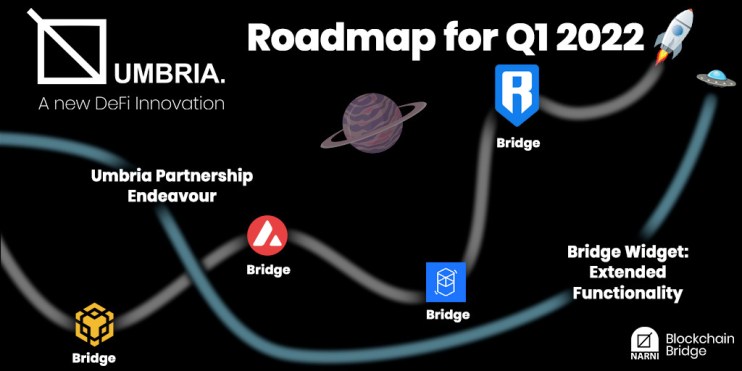

Currently available between Ethereum and Polygon, and Ethereum and Binance Smart Chain, further bridges will be rolled out for Avalanche, Fantom and RONIN in Q1 of 2022.

Introducing Umbria’s ‘Narni’ Liquidity Bridge

The Polygon network (formerly Matic) is one of the prime blockchains addressing the scalability and gas cost issues of Ethereum. It has exploded in popularity over the last two years – it currently has $5.2 billion TVL according to DefiLlama. The sticking point has been bridging over from Ethereum to Polygon in order to engage in the applications on this network.

Polygon’s native bridge is slow and extremely expensive, which dramatically eats into the cost savings afforded by its network in the first place. If gas prices are high, it can cost in excess of $300 to transfer assets, and can take many hours for funds to show up on the Polygon network. This doesn’t make for a pleasant experience.

With the Narni bridge – which currently supports ETH, Wrapped BTC, USDC, USDT, MATIC, GHST and Umbria’s native token UMBR – it typically takes fewer than four minutes and often costs just $4-$9 to transfer assets from the Ethereum to the Polygon network, representing approximately a 90% discount to other solutions. This has garnered Narni legions of fans across the board but particularly amongst the NFT community who regularly have to convert ETH to Wrapped ETH (WETH) to mint and buy/sell NFTs or to interact with NFT metaverses and ecosystems such as Zed Run.

Narni is opening the door to many for whom previously bridging between these two blockchains wasn’t economically viable.

Umbria has just launched its Binance Smart Chain (BSC) bridge, which facilitates the bridging of ETH from the Ethereum Mainnet network to BSC. It is currently the cheapest and quickest cross-chain bridge for ETH between these networks.

Narni is also very useful to anyone seeking to take advantage of arbitrage opportunities by providing a pathway between DEXes where price discrepancies between asset pairs can now be capitalised upon.

APY and no impermanent loss

In addition to benefiting from incredibly fast and inexpensive transactions, users of Narni can put their crypto assets to work and earn interest with its ‘pool and earn’ feature (https://bridge.umbria.network/pool/). Liquidity providers lend their asset/s to the pool on either (or both) sides of the bridge and receive a proportion of the fees accrued when other participants bridge that specific asset between those networks. $UMBR stakers receive even greater rewards as they earn their share of a 0.3% fee whenever anyone transfers any of the assets supported by the bridge cross-chain.

The rewards earned – which are auto-harvested – are paid in the assets used to bridge between networks and are added to the staking balance of each token on the respective network. Unlike many other platforms, where users provide liquidity as a pair of two different tokens and can lose upside due to the change in value of the underlying assets, on Narni there’s no impermanent loss as only one asset is provided as liquidity.

There’s no lock-up period so tokens can be un-staked at any time. Umbria currently offers the highest APYs with no impermanent loss for Ethereum.

What’s next for Umbria Network?

Decentralised applications (dApps) are increasingly building away from the Ethereum network; different chains have different use cases, which may be more advantageous to a particular project. As the future of crypto becomes more interoperable, Umbria is focused on launching multiple bridges between lots of different networks in quick succession. This will enable communities to easily and cheaply move their assets between these different networks and engage with a full spectrum of DeFi and NFT platforms.

The developers will be expanding and scaling the project out to other popular networks (and will look at community recommendations) as well as up-and-coming ones they believe are going to get the most traction over the next five or so years. Avalanche chain will launch in February followed quickly by the Fantom bridge; 10 bridges are in the pipeline for 2022.

Q1 will also see the launch of the Umbria Partnership Endeavor. This will see the project collaborating with lots of different NFT and DeFi protocols and enabling them to onboard their users onto their platform on numerous EVM-compatible chains using the Narni bridge. Linked to this is Umbria’s bridge widget, which has all the core functionality of the Narni bridge.

Umbria can provide projects with the widget, which they can re-brand and fully integrate into their platforms. Their users will be able to seamlessly migrate their assets to the correct chain all within their native environment without needing to know about Umbria or the process of bridging. In Q1, the widget’s functionality will be extended to include a fiat on-ramp so people can use a credit card to buy crypto and get straight to their destination network rather than having to have assets in a separate wallet and switching between different interfaces.

View the full road map: https://umbria.network/

https://coinmarketcap.com/currencies/umbria-network/

Purchase $UMBR