Ultra-high energy bills are here to stay, warns Cornwall Insight

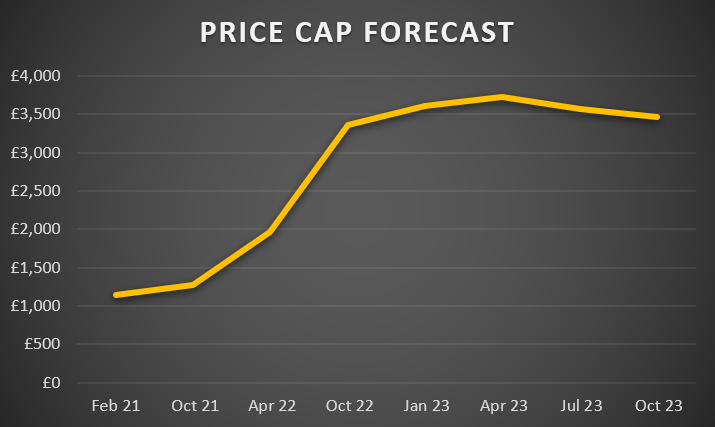

Household energy bills will remain historically elevated into 2024, revealed Cornwall Insight, meaning the cost of living crisis will not be easing for Brits any time soon.

The energy specialist warned in its latest gloomy analysis on the price cap that a typical household’s energy bill will be well over £3,000 per year for at least the next 18 months.

This will peak in second quarter of next year, when prices for the default tariff are expected to average £3,729 per year – which will barely ease over next summer.

The painful longevity of high household energy bills, which spiked to a record £1,971 per year this April, has been powered by booming post-pandemic demand and continued wholesale market volatility following Russia’s invasion of Ukraine.

There are now extensive concerns over Russian gas supplies ahead of winter, with the Kremlin-backed gas giant Gazprom severely cutting flows into Europe in recent weeks amid a dispute over a turbine for a key pipeline.

The troubled continent relies on Russia for around 40 per cent of its imports, and the European Union (EU) is scrambling to secure alternative supplies and cut usage to reduce the possibility of blackouts and supply shortages.

While the UK only relies on Russia for four per cent of its gas supplies, markets are global and the domestic benchmark is volatile to instability in Europe.

The UK is connected to European supplies via interconnectors, and its primary vendors such as Norway are also looking to help the EU meet its energy needs.

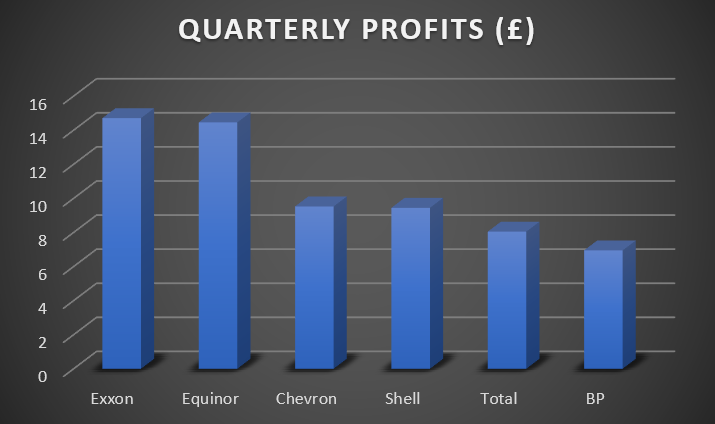

Energy giants are making vast profits from soaring oil and gas profits, with BP the latest to unveil bumper second quarter earnings.

Rivals such as Shell and Equinor, alongside Stateside operators such ExxonMobil and Chevron have also reported massive profits.

Market carnage drives up energy bills

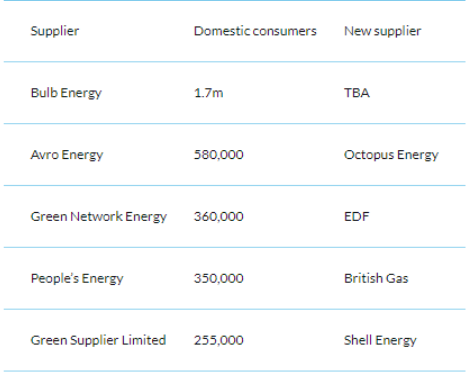

Alongside geopolitical uncertainty, the price cap has been influenced by market carnage – which has seen nearly 30 suppliers collapse over the past 12 months.

The clean-up costs include £2.7bn for the supplier of last resort process – which will be imposed on energy users – and around £3bn for Bulb Energy’s de-facto nationalisation – which will be met by taxpayers.

Its predictions are based on the price cap moving to a quarterly model, which is favoured by Ofgem in a “tend-to” consultation.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight, recognised that “customers will be sadly used” to ever-increasing price cap forecasts.

He said: “We have less than a month until the new price cap is announced and given the trends in the wholesale market and the concerns over Russian supply, unfortunately the only change to the prediction is likely to be up. However, while the rise in forecasts for October and January is a pressing concern, it is not only the level – but the duration – of the rises that makes these new forecasts so devastating.”

Dr Lowrey noted that the Government pledged significant support for energy users – up to £1,200 per year for vulnerable households.

However, since the announcement in April from former Chancellor Rishi Sunak, Cornwall Insight’s forecast for October has spiked £500 to £3,358 per year.

He concluded: “Our new figures show that even increasing support for October will not make much of a dent in what is likely to be a sustained period of high energy bills. A review of delivering support for the next cap periods should be on the top of the to-do-list for any incoming Prime Minister. As our price cap breakdowns show, tinkering with VAT and policy costs will only make a dent in bills, when it is the high wholesale prices behind the increases.”

Cornwall Insight’s predictions follow forecasts from BFY Group the price cap will rise to £3,420 per year in October and £3,850 per year next January – in the coldest month of the year when demand is at its peak.