UK’s smaller firms cannot pay debts amid coronavirus, say accountants

The UK’s small and medium-sized businesses do not have enough cash to pay debts due in the next year, research has shown, as fears rise over the resilience of British firms in the face of the coronavirus slowdown.

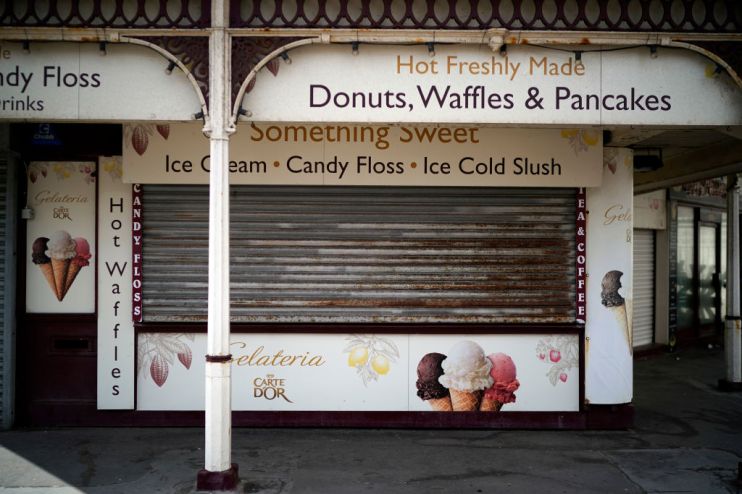

Coronavirus containment measures have pushed businesses to close and caused a slump in demand. This has caused a crisis among Britain’s smaller businesses, which have seen cash flow dry up.

The average smaller UK business now only has 95 per cent of the cash, or other liquid assets, to cover debts due in the next 12 months, according to analysis of 13,000 balance sheets by accountants UHY Hacker Young.

Things are likely to get even worse as economic output plunges, the firm said, with the squeeze on cash flow likely to intensify.

“A lot of SMEs have seen their incomes drop precipitously almost overnight,” said Martin Jones, partner at UHY Hacker Young.

“Cost-cutting isn’t going to fix the problem – many will need emergency support from the government as well as swifter payments from their debtors to make it through this crisis.”

The government has promised to lend £330bn to struggling companies. But business groups have complained that the lending is not reaching all firms fast enough due to a number of hurdles that have to be cleared.

On Thursday, chancellor Rishi Sunak made some changes to the coronavirus business interruption loan scheme (CBils) aimed at small businesses. For example, firms do not have to have been refused a normal bank loan before applying.

Despite the unprecedented loan schemes, the UK is bracing for many corporate failures. Separate research from yesterday suggested that unpaid business debt is set to double to more than £8.6bn this year.

Business information firm Red Flag Alert argued that more than 10 per cent of businesses in financial distress will fail this year.

“This will leave a trail of insolvent debt totalling £8.6bn this year and could see levels of bad corporate debt in 2021 rising beyond £15bn,” the research said.