Could UK’s nuclear power deadlock be broken by the emergence of ‘cheaper’ thorium SMR technology?

The UK’s nuclear power ambitions are at risk of stalling, less than a year after the Government unveiled vast generation targets to revive the industry and replace the country’s ageing fleet.

The most recent blow is the year-long push back in funding for Rolls-Royce’s small modular reactors, with ministers squabbling over the costs involved in its rollout.

SMRs are constructed in stages at factories and then transported to the designated site, reducing assembling costs and making them quicker to build.

Rolls-Royce’s funding delays has thrown the door open for rival players to present their ideas to revive the sector and ensure the UK can meet its vast targets to ramp up generation over the coming decades.

One of these potential suitors is Danish energy specialist Copenhagen Atomics, which is proposing SMRs powered by molten salt and metallic chemical element thorium, rather than the typical uranium fuel cycle and water.

Copenhagen Atomics presents new concept

Copenhagen Atomics has submitted a proposed design for its reactor through its British subsidiary, UK Atomics, for 100MW thermal reactors which would then be connected to a producer’s generators and turbines.

Michael Drury, managing director of UK Atomics told City A.M.: “We have a very simple design which allows it to be much faster. It is almost like in the water industry where you can plug in to your main connections, and then they’re able to operate. So, they are direct plug and operate.”

The company calculates it can provide energy at a rate as low as £40 per megawatt hour (MWh), below the target price of Rolls-Royce’s light water reactors of £50 to 70 per MWh.

It is hoping to develop sites of as many as 25 geothermal units for each plant in the UK – with a target date of 2028.

…it’s an opportunity for the UK to be a world leader in a new technology – and they should want to be at the forefront of nuclear development.”

Michael Drury, managing director at UK Atomics

Copenhagen Atomics argues its design is not just cheaper to assemble, produce energy and is more efficient in reducing waste – burning up 98 per cent of actinides compared to just five per cent from a light water reactor.

The UK has currently has around 140 tonnes of spent fuel stockpiles stored – which costs £73m to store per year – the cost of its disposal is predicted at £50bn.

The company estimates it could generate 30GW of power from the fuel stockpile – if this was generated at a price of £59 per MWh, would create £780bn worth of energy over 50 years.

They are also not looking for upfront contributions from the taxpayers – and are instead funded privately from currently unnamed European and US investors.

Thomas Steenberg, chief executive of Copenhagen Atomics, explained: “UK Atomics wants to own and operate the nuclear power station and then sell the energy on a power purchase agreement. So, there will be no upfront investment from the taxpayers’ point of view.”

Early stages for future-facing nuclear plant

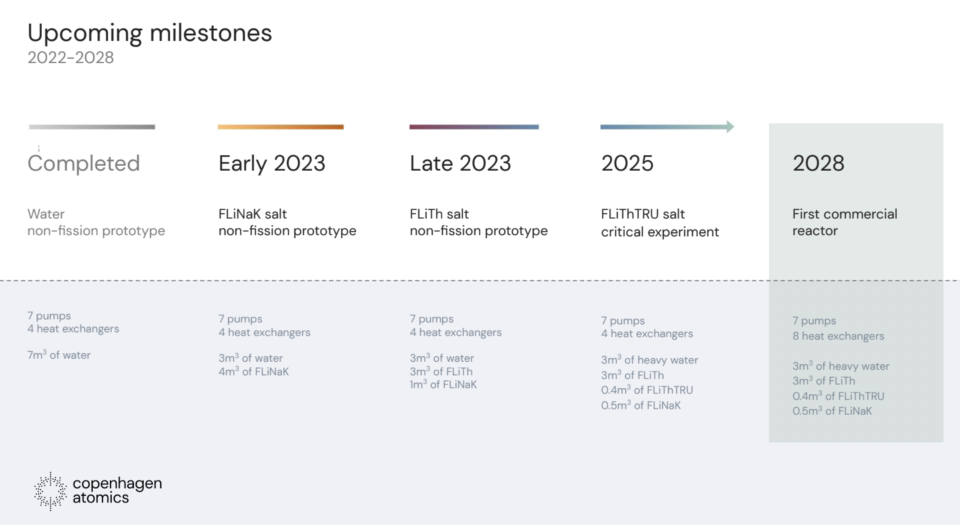

Copenhagen Atomics hopes to begin assembling power plants as soon as 2028, however it has only just entered the government’s generic design assessment process for approval – which can take years – and is still in the prototype construction stages for its reactor, with no operating sites to point to.

A leading nuclear industry expert at a global consultancy argued it was “unlikely” thorium-powered plants could present an alternative to light water reactors.

He told City A.M.: “They have well-known advantages; however, light water reactors have a 60-plus year lead in terms of design, licensing, construction, regulation, operation and commercialisation. It is difficult to see how thorium can catch up to become competitive. It would have been different had a commercial thorium programme started 60 years ago.”

In response to this critique, Drury argued the UK has a proven track record in developing reactors, such as Chapelcross and Dounreay PFR in the 1950s, which he wanted to revive.

He believed “UK Atomics was following this path” – backed when new reactors were developed from concept to commercial operation within four to five years.

The managing director argued: “The market is so large that it would be a pity to only implement one technology. We should be looking to implement all technologies as each have different applications and timeframes. So much energy is needed to meet our Net Zero commitments by 2050 that we should enable market progress as much as possible.”

Drury was highly aspirational about its potential role in the UK’s energy mix, and could change the game for the nuclear industry.

He said: “I really see that molten salt reactors have a key part to play as we go forward and actually can offer something very different to other reactor types.

“We should be working to develop that technology, because fundamentally, it’s an opportunity for the UK to be a world leader in a new technology – and they should want to be at the forefront of nuclear development.”

The nuclear industry is also bullish over its potential.

Tom Greatrex, chief executive of The Nuclear Industry Association considers the design to be an “exciting step forward” for next generation SMR reactors in the UK.

He said: “It offers another innovative way of producing abundant clean energy to ensure energy security and hit our net zero goals alongside other reactor types and clean energy sources.”

It now remains to see whether such optimism will survive the rigours of the government’s approval process, and whether the UK will be home to a new advancement in nuclear power, or merely a fascinating concept that fails to survive the realities of the construction phase.

| Power Plant | Closing Date |

| Hartlepool | 2024 |

| Heysham 1 | 2025 |

| Heysham 2 | 2028 |

| Torness | 2028 |

| Sizewell B | 2035 |