UK’s industrial recovery on track with production rise in the third quarter

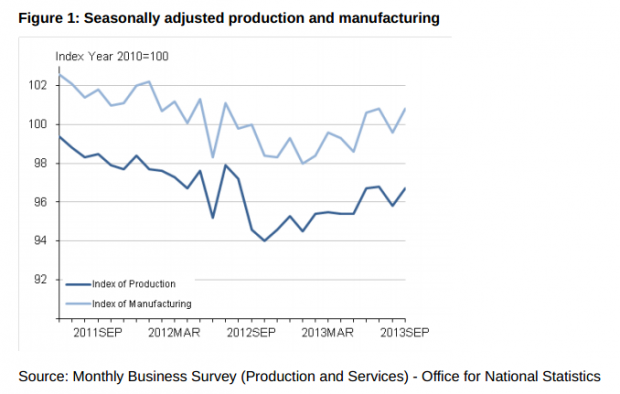

The industrial production of UK companies rose by 0.9 per cent in September, beating expectations of a 0.7 per cent increase. Production output rose by 0.6 per cent between the second quarter 2013 and the third.

Manufacturing output for September also went up, by 1.2 per cent, beating expectations of a 1.1 per cent increase, after August's fall of 1.2 per cent. The quarterly growth was mainly attributable to manufacturing, which increased by 0.9 per cent over the period – similar growth to that seen in the second quarter.

September's figures show that the sector is continuing to recover, "albeit more slowly than indicated by the recent surveys", says Capital Economics' Samuel Tombs. He added that the rise, though slightly bigger than the figure predicted, won't be enough on its own to initiate an upward revision to GDP growth. The NIESR GDP estimate is due out at 3.00pm today.

A surprise fall in industrial production in August was deemed by a number of economists to be a temporary blip, although some said it posed a downside risk to third quarter growth.

Production output was as a whole was 2.2 per cent higher in September of this year than it was in September 2012. Mining & quarrying rose by 11.5 per cent, whilst water supply, sewerage & waste management saw a 7.1 per cent increase. Gas, electricity, steam and air conditioning went up by 3.4 per cent and there was a 0.8 per cent rise in manufacturing.

Tombs comments:

Admittedly, the industrial recovery is still falling short of the pace indicated by many of the manufacturing surveys. But the official data should paint a stronger picture soon. In particular, the 5.7 per cent quarterly fall in production in the energy supply sector – which knocked about 0.5 percentage points off overall growth in industrial production in Q3 – partly reflected the temporary effect of the quarter's unusually warm weather on demand for heating.

Moreover, with recent improvements in business confidence suggesting that firms are becoming more willing to invest and no signs yet that the recovery in consumer spending is fading, the near-term outlook for manufacturers looks bright.