UK’s competition regulator has killed more deals than the EU’s watchdog since 2019

Britain’s antitrust watchdog, the Competition and Markets Authority (CMA), has thwarted more deals than its European counterpart over the past five years, as antitrust screening tempers the pace of mergers and acquisitions (M&A).

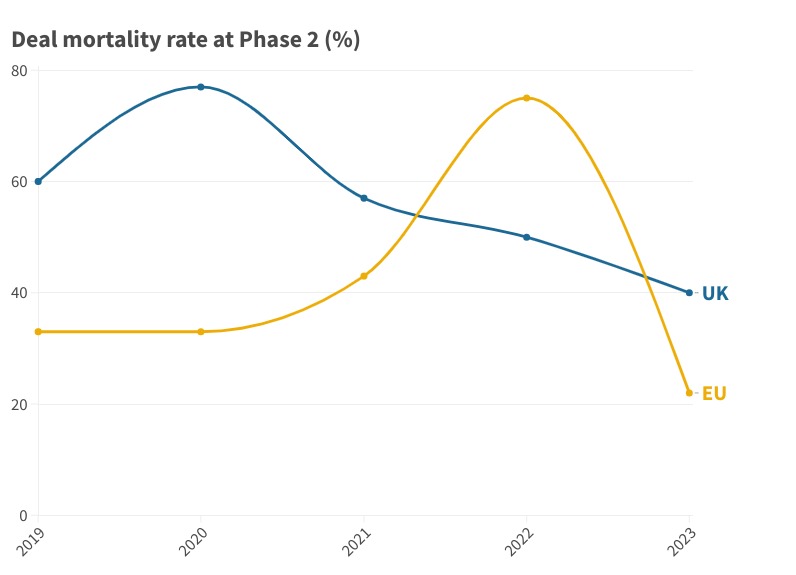

Average UK deal mortality rate over the five year period from 2019 to 2023 was 57 per cent, while in the EU it stood at 41 per cent, according to new data from Magic Circle law firm Linklaters, shared with City A.M.

The data shows that the CMA has blocked more tie ups than the European Commission (EC) every year bar one in the past half a decade.

Linklaters’ analysis focused on Phase 2 investigations by the regulators, where a fifth of cases have undergone or are undergoing simultaneous review, totalling 11 cases.

Deal mortality refers to prohibition, unwind, and deal abandonment upon referral or during Phase 2 investigations.

Verity Egerton-Doyle, partner in Linklaters’ antitrust and foreign investment team, highlighted that outcomes are “broadly aligned” between the watchdogs.

But she said instances of divergence are increasing, particularly in the last year, with the CMA clearing two of the tech deals that the EC had blocked. “Neither of these were typical mergers of ‘horizontal’ competitors,” she said.

“While intervention rates for different authorities are instructive – albeit highly influenced by what cases come before them in a given year given the small sample size – the key from a dealmaker’s perspective is that if one major authority blocks a deal, it cannot proceed: lightning only needs to strike once,”Egerton-Doyle explained.

Last year only three parallel cases were cleared unconditionally on both sides of the Channel. Two of these were at Phase 1 and one at Phase 2, which was the Viasat and Inmarsat tie up.

She added: “High intervention rates in the UK and EU, along with a more hostile environment in the US, have shifted the cost-benefit analysis for taking on regulatory risk, meaning there are more deals that don’t leave the board room and when they do, it is often with stringent contractual protections.”

It comes as the UK is now the second most targeted nation for M&A globally, following the US. The value of deals in the country hit $76.1bn (£60.2bn) in the first three months of the year, an 88 per cent increase compared to 2023.

However, this remained below the value of the previous three years and the actual number of deals fell by a quarter, according to data from the London Stock Exchange Group.

Simon Branigan, global head of Linklaters corporate division, also said deals are taking longer to close and becoming increasingly complex due, in part, to “antitrust regulators becoming much more interventionist and less predictable.”

Last year the CMA sparked criticism after it blocked Microsoft’s Activision deal, but the Commission cleared it in May.

President of Microsoft Brad Smith said the watchdog’s initial decision was “bad for Britain” and marked the firm’s “darkest day in our four decades” in the UK. Under pressure, the UK regulator gave the green light several months later, after concessions were made.

A CMA spokesperson said: “Last year we blocked fewer than one per cent of the deals we considered. When we do intervene it is to protect UK consumers and businesses against anti-competitive mergers that could cause harm.”