UK will struggle to meet lithium shortfalls from allies amid China dominance, minerals boss warns

The UK will struggle to meet its lithium needs from deals with friendly allies, the boss of Cornish Lithium fears, paving the way for a greater reliance on China unless domestic production is boosted.

Jeremy Wrathall, chief executive of Cornish Lithium, told City A.M. he would prefer the UK to reach partnerships with companies in Australia and Canada for any shortfalls in domestic supplies, but both countries are already facing huge demand from global markets.

“We will struggle to purchase lithium from them to process here in the UK,” he said, with lithium consumption also swelling in Asia and North America.

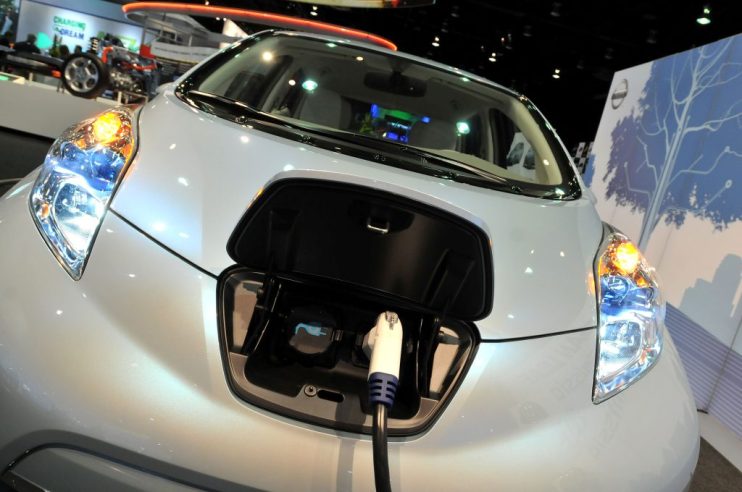

Lithium is an essential mineral in battery manufacturing for electric vehicles – which makes up to 80-90 per cent of its booming demand worldwide — with the mineral dubbed ‘white gold’ within the industry.

Cornish Lithium is a mineral exploration company, and aims to produce 8,000 tonnes of battery-grade lithium per year by 2026, which would meet more than 10 per cent of the UK’s annual needs.

The UK needs between 53,000 and 70,000 tonnes per year of the silvery-white metal to meet EV demand in 2030, according to research specialist Rystad.

However, Rystad calculates the UK is only on track to secure around 35,000 tonnes per year by the end of the decade.

This challenge comes amid a raft of investments in electric vehicle manufacturing with state funding signed off for Jaguar Land Rover’s upcoming mega-factory in the UK.

Wrathall noted that continental Europe would not come to the country’s rescue, as it produces almost “zero” battery-grade lithium to help meet the UK’s supply needs.

Europe accounts for more than 25 per cent of battery-grade lithium demand but produces just one per cent of global supplies, according to data from Benchmark Mineral Intelligence.

Metal analysts Fastmarkets forecast that European mine supplies will rise to 135,000 tonnes of lithium carbonate equivalent by the end of the decade, but that EV demand will reach 380,000 tonnes in the same year, a shortfall of approximately 245,000 tonnes that will have to be plugged overseas.

China remains the dominant player in global lithium markets, with the International Energy Agency estimating the country produces three-quarters of all lithium-ion batteries.

In these challenging circumstances, Wrathall believed the UK needed to do more to exploit its own resources, and praised Labour’s pledge to liberalise planning rules to ramp up infrastructure building if they win the next election.

He argued it was “a wake-up call to everybody” and that “more horsepower is needed” to beef up planning, which remained “under-resourced” and in need of more expertise to approve projects in a “new industry.”

“More should be done to bolster that,” he said.

His comments follow another bullish operational update from the company, which revealed successful drilling operations and testing across its assets, including at its Trevalour project – where Cornish Lithium hopes to produce 7,800 tonnes per year from a repurposed clay pit.

It is also exploring further opportunities to develop lithium from brine deposits, with another progress update expected in early 2024.

Cornish Lithium, which is one of two major potential UK lithium developers in the South West alongside British Lithium, bolstered its future with a £53.6m funding package in August.

It is now assembling a wider £200m-plus package required for potential second stage financing – which could kick-start full-scale production.

When approached for comment, minister for industry and economic security Nusrat Ghani said: “We’ve already delivered the Critical Minerals Refresh to ensure we’re taking action on a number of fronts to reinforce the resilience of our supply chains, including signing critical minerals agreements with countries such as Australia and Canada, deepening cooperation with the US through the Atlantic Declaration, increasing links to international markets and accelerating the UK’s domestic capability.

“We committed £24m from the UK Infrastructure Bank to Cornish Lithium and £15m from Innovate UK to research and development investments, both of which will be key to securing our domestic supply of critical minerals for years to come.”