UK startups bag £4.2bn as VCs shrug off recessionary fears

Venture capital investors in the UK and Ireland shrugged off recessionary fears in the third quarter of the year as they pumped £4.2bn into start-up firms, new research has revealed.

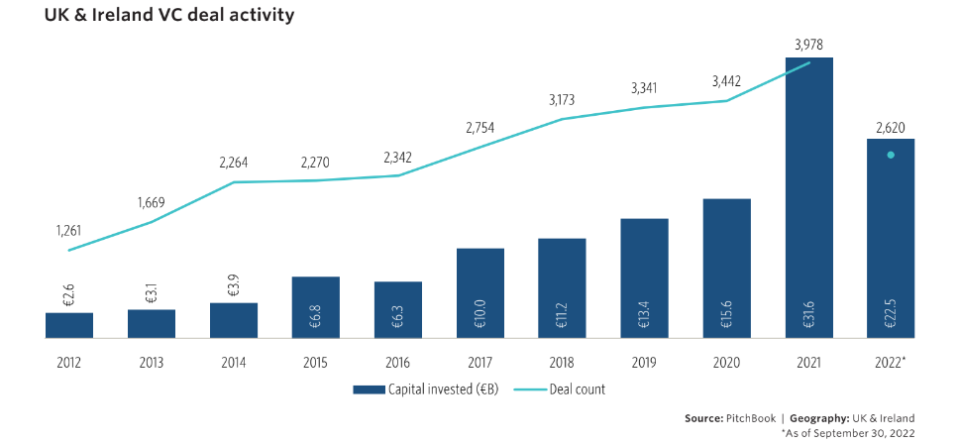

The bumper quarter takes total VC funds pumped into in the UK and Ireland to £18.8bn this year, putting the rate of investment on track with the record levels of cash racked up last year, according to a new report by investment data firm Pitchbook.

The figures have bucked worries of a cliff-edge drop in UK investment in the three months through September as inflation and rising interest rates choke off an easy source of cash for investors.

Analysts at Pitchbook said the figure could begin to flatten out in the fourth quarter, however, as policymakers continue to hike rates to tame rampant inflation.

“The shift in monetary policy from historically low interest rates that promoted growth, spending, and borrowing is notable and its impact on the VC dealmaking environment will be clearer as we progress into Q4 2022,” said Nalin Patel, lead analyst, EMEA Private Capital at Pitchbook.

“VC deal activity growth has been considerable year-over-year (YoY) during the past decade, and we believe a flattening could take place in 2023, rather than a sharp decline.”

Later stage firms raising cash in the coming months are likely to experience “haircuts” however, PTEL warned, as valuations plunge from frothy highs experienced last year.

Some of the most high profile rounds of the quarter have been marked by tumbling prices. Buy-now pay-later giant Klarna closed a €767m round in the quarter at a valuation of €6.4bn, 85 per cent down from the $46bn valuation it fetched in 2021.

The resilient levels of UK investment came amid a turbulent few months across the continent however, as total investment tumbled 36.1 per cent to €18.4bn, its lowest quarter since the fourth quarter of 2020.

Patel said that the headline figure for investment could still be an annual record at the current pace, however.

“While pace throughout 2022 appears to have kept up with 2021, Q3 has delivered the decline in dealmaking activity that many analysts have anticipated this year,” he said.

“However, we could finish the year with the highest recorded annual deal value in Europe if activity picks up in Q4.”