UK should not push through Edinburgh reforms, top banking expert warns

The government should not relax financial sector regulations at a time when banks are already facing severe pressure, a senior banking expert has warned.

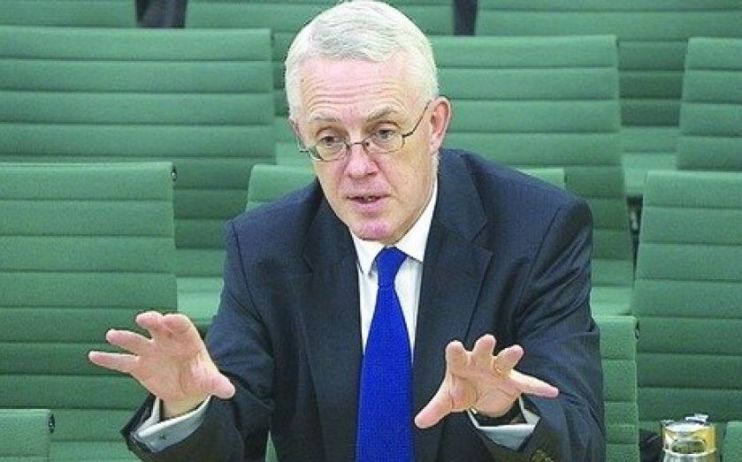

John Vickers, former chair of the independent commission on banking, told City A.M. that “current events should put an end to any thoughts of rolling things back,” referring to the government’s proposed Edinburgh reforms.

The Edinburgh reforms, announced by the government in December last year, are designed to “unlock investment and turbocharge growth” by repealing “burdensome pieces of retained EU law”.

The proposals include relaxing ring-fencing rules, which separates a bank’s riskier operations from its retail division, and scrapping the cap on bankers’ bonuses.

Despite the turmoil, the government has insisted it will press ahead with the Edinburgh reforms.

But Vickers said the recent turbulence in the banking sector highlighted the importance of the ring-fencing regime, especially as regulator’s appear unwilling to put banks into resolution.

Resolution rules are designed to ensure the continuation of critical functions across both sides of the ring-fence in a bank. Some have suggested that effective resolution rules removes the need for a ring-fencing regime.

Regulators in the US and Europe have so far avoided putting banks into resolution, and even expressed doubt that resolution rules could work as intended.

However, Vickers argued “the fundamental UK architecture of ring-fencing should remain the same” even if he was “not against adjustments at the margin”.

Vickers also said he was “sceptical about the toughness of stress tests we’ve seen so far from regulators”.

Vickers has long been a proponent of conducting stress tests that take into account the market value of banks’ assets alongside the book value. The majority of banks in Europe have a price to book ratio below one, meaning the market values the company at less than the total value of its assets

“For a bank with a price to book ratio well below one, it should not be taken for granted that book value is an accurate measure of equity upon which to base the test…there should at least be the question of whether it is accurate,” Vickers said.

Some stress tests conducted pre-Covid concluded higher interest rates were beneficial for banks, which Vickers noted was “somewhat ironic considering what’s happened”.

One of the main reasons Silicon Valley Bank collapsed was that it sold a large portfolio of government bonds at a significant loss as a result of rising interest rates.