Food prices continue to skyrocket despite easing UK shop inflation

UK inflation is beginning to ease, but food prices are still accelerating at one of the fastest paces on record, new research out today shows.

Annual shop price inflation, calculated by the British Retail Consortium (BRC) and NielsenIQ, dropped slightly to 7.3 per cent last month from 7.4 per cent in November.

Despite the drop, the rate of price increases is still running at among the quickest since the BRC started tracking the data.

Worryingly, food price inflation, which jumped to 13.3 per cent from 12.4 per cent, drove overall shop prices higher. Non-food inflation decelerated to 4.4 per cent in December from 4.8 per cent in November, while fresh food prices climbed 15 per cent over the last year.

Rising food prices erode purchasing power sharply due to households struggling to curb spending on filling their fridges and kitchen cabinets.

Food retailers are being incentivised to lift prices to offset rising costs caused by Russia’s invasion of Ukraine sending international energy prices flying and gumming up European supply chains.

The war has resulted in Ukrainian grain exports remaining moored in the country, engineering global shortages of inputs used to produce basic foods and lifting costs in the process.

The BRC’s figures indicated retailers were passing on the “reverberations from the war in Ukraine continu[ing] to keep high the cost of animal feed, fertiliser and energy” to consumers, BRC chief executive Helen Dickinson said.

The squeeze on retailers from higher energy costs is being partly absorbed by the government covering a portion of their bills.

However, the scheme is expected to be watered down from the end of March due to Chancellor Jeremy Hunt pushing to shield taxpayers from the risk of a resurgence in gas and oil prices – which are now trading at pre-Russia-Ukraine war levels – in 2023.

Dickinson warned retailers may raise prices after the government scales back help.

“Further high investment in prices may no longer be viable once the government’s energy bill support scheme for business expires in April,” she said.

“Without the scheme, retailers could see their energy bills rise by £7.5bn. Government must urgently provide clarity on what future support might look like or else consumers might pay the price,” she added.

Hunt is expected to set out details on how the policy will be reshaped to target the most vulnerable businesses early this year.

The BRC’s figures suggest consumers will cut spending in 2023 due to persistent and high inflation eroding their living standards, likely driving what will be an at least year-long recession.

“The increase in food inflation is going to put further pressure on household budgets and it’s unlikely that there will be any improvement in the consumer mindset around personal finances in the near term,” Mike Watkins, head of retailer and business insight at NielsenIQ, said.

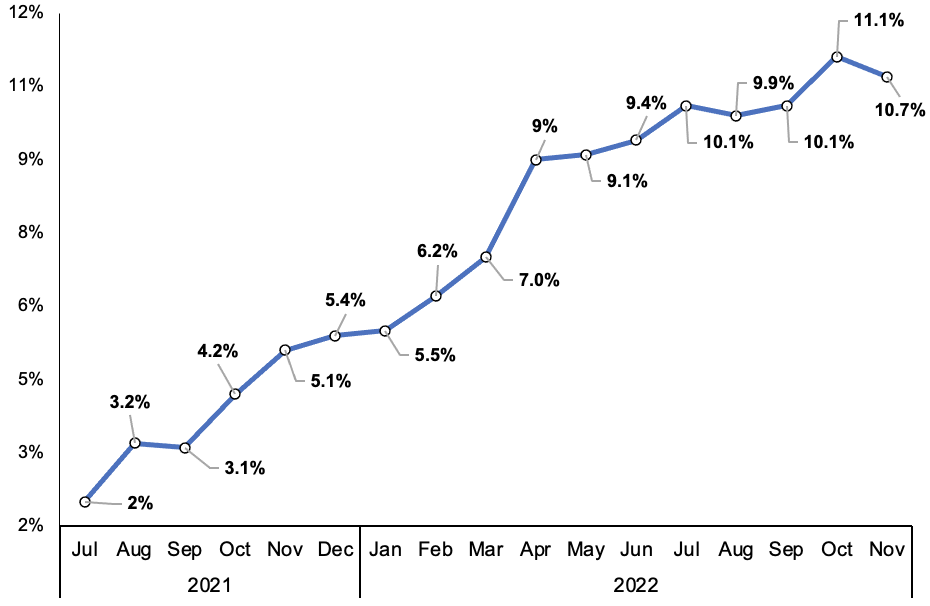

Official inflation, calculated by the Office for National Statistics, dropped to 10.7 per cent in November from 11.1 per cent in October, prompting economists to bet the rate of price rises has passed its peak.

Annual CPI inflation may have passed its peak