UK services growth slumps to six-month low despite record hiring rates

UK services firms hired workers at the fastest pace on record in August to cope with soaring demand, but growth in the industry slumped to a six-month low amid severe shortages, according to a closely watched survey released today.

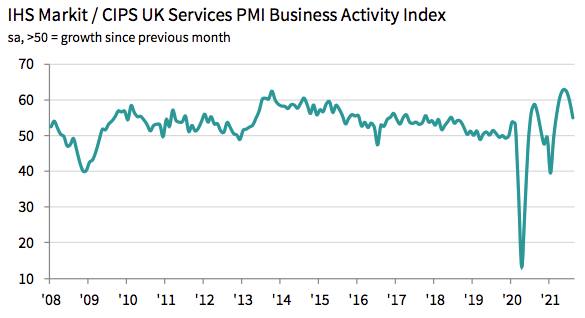

The latest IHS Markit / CIPS UK services PMI survey dropped to 55.0 in August, the lowest since the industry returned to growth after lockdown, and down from 59.6 July.

A reading above 50 indicates growth. Economists had expected the reading to come in marginally higher at 55.5.

Weaker growth in the industry, which represents around 80 per cent of the UK economy, was partly driven by consumer spending pulling back from elevated levels seen in the immediate aftermath of the easing of Covid restrictions.

Martin Beck, senior economic advisor to the EY Item Club, said: “That the large gains from reopening the economy after lockdown have passed meant a softer pace of services growth wasn’t unexpected.”

A scarcity of workers – despite the highest level of hiring in the industry since the survey began 25 years ago – across many sectors of the UK economy is feeding into supply chain snarl ups, resulting in businesses struggling to source materials needed to deliver services, which is crimping output.

Backlogs of work in the services industry have swelled for six months in a row, primarily the result of staff shortages, IHS Markit said.

Labour supply has been hit by several factors, including intense reticence to return to work from furlough due to concerns about the long-term viability of roles, a lack of childcare provision and younger workers re-entering education.

High levels of EU workers leaving the UK since the onset of the pandemic, combined with stricter immigration rules since Brexit, has contributed to a mounting skills shortage, particularly in the leisure, hospitality and logistics sectors.

Tim Moore, economics director at IHS Markit, said: “The service sector lost momentum for the third consecutive month as the impact of looser pandemic restrictions faded in August.”

“Many businesses suffered constraints on growth due to staff shortages, self-isolation rules and stretched supply chain capacity.”

Reticence among workers to take on new roles prompted services businesses to hike salaries in a bid to attract talent, increasing costs for the industry.

Meanwhile, “rising fuel bills and greater transport costs were the main factors contributing to higher operating expenses in August,” IHS Markit said.

44 per cent of services businesses reported rising input costs, while the rate of cost increases was only marginally lower than July’s record high, fuelling fears inflation in the UK economy could start to motor.

The Bank of England expects price rises to reach four per cent this year, although analysts expect inflation to climb above this. It currently stands at two per cent on an annual basis.

“Tight labour market conditions pushed up wages as service sector companies sought to attract and retain employees. The overall rate of input cost inflation remained steep, but eased from the record high seen in July,” Moore added.

The reduction in services growth contributed to a combined measure of private sector output growth dipping to 54.8 in August, down from 59.2 in July, IHS Markit said.

But, business optimism did edge up to a three-month peak as expectations that Covid lockdown measures would need to be reintroduced receded.