UK’s top firms paid higher tax rate last year

THE BIGGEST listed firms in the UK paid a higher tax rate on their profits last year, reversing several years of decline, according to new research.

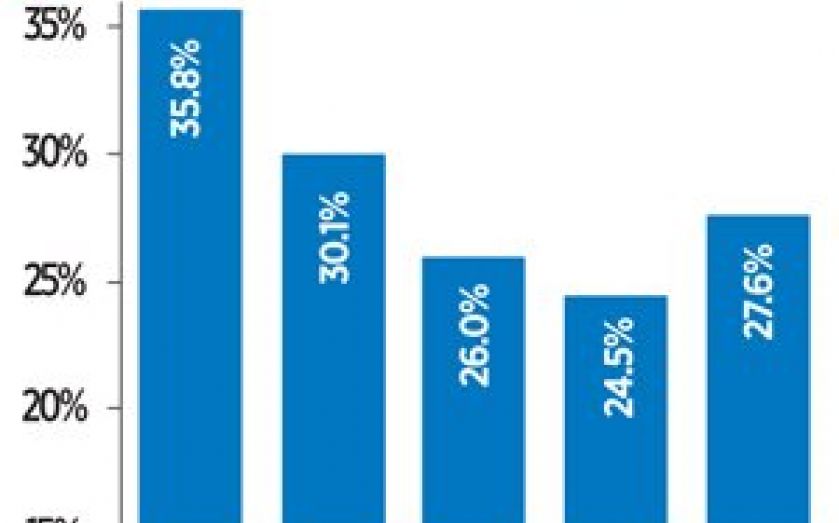

In the past year, the average effective tax rate on FTSE 100 firms rose to 27.6 per cent of profit after four years of decline, according to accounting and auditing firm UHY Hacker Young.

The rate rose from 24.5 per cent in 2012, climbing back towards levels last seen in 2010. But the overall amount of tax fell as profits dipped. Last year FTSE 100 companies paid £51bn in tax on profits of £143bn, down from £58bn paid on profits of nearly £188bn in the previous year.

UHY Hacker Young said that the higher tax rate is partly due to large fines and compensation payments, which are not tax deductible.