UK risks missing energy goals due to poor investment climate, industry body warns

The UK’s net zero and energy security ambitions are at rrisk from its poor investment environment, the country’s leading energy industry body has warned.

Energy UK’s latest report on industry investment argues that the financial climate for ramping up renewable spending and boosting low carbon generation has deteriorated significantly in recent months, threatening to undermine the country’s ambitious green agenda and damage the wider UK economy.

It argues a range of factors are stifling green investment including inflation, interest rates, supply chain difficulties, planning hurdles and poorly designed windfall taxes.

This has driven up the cost of some new low carbon projects as much as 50 per cent, the industry body reports.

Energy UK also fears the US Inflation Reduction Act and the pledged loosening of subsidies in the EU risks driving money overseas away from the UK.

The industry body warns that without taking action to address investor uncertainty, the UK economy could lose out on £62bn of investment between now and 2030.

This would lead to higher bills for customers, as private funding is essential to the energy transition with an estimated £500bn in additional power sector investment needed between now and 2050 to meet the UK’s net zero goals.

Policy changes key to seize energy opportunity

Energy UK has called for reforms to the Electricity Generator Levy – the windfall tax on electricity generators – such as including investment relief in the tax.

It also favours increasing the amount of generation supported by the Contracts for Difference scheme, and decoupling electricity prices for existing low carbon generation from marginal prices set by gas.

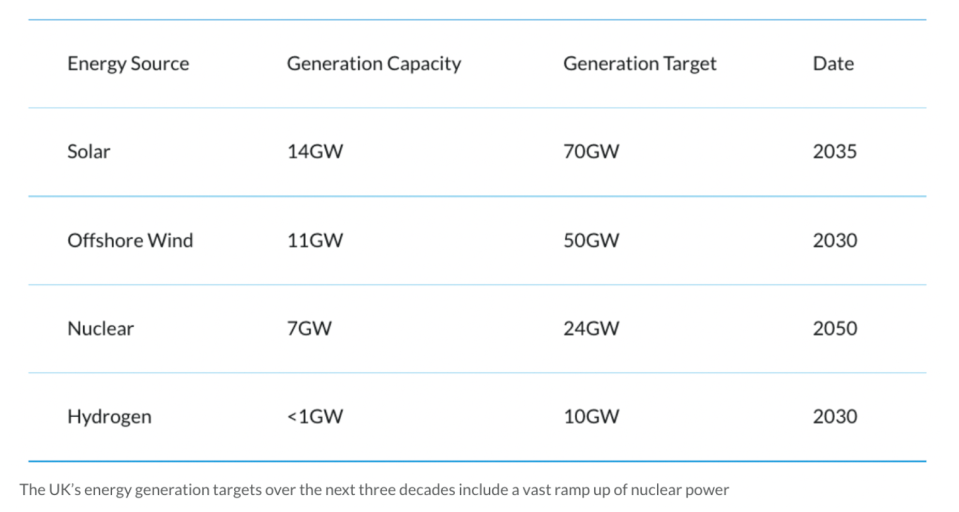

This would lead to a shortfall of 54GW of potential wind and solar capacity, which represents enough generation to power every home in the UK.

Chief executive Emma Pinchbeck said: “The UK is in increasing danger of undermining its own ambitions and failing to deliver on its commitments. In many ways, the UK has led the way in the transition to clean energy – witness our world leading offshore wind industry – but we risk squandering this position and driving the investment that we need elsewhere.

“We are at a pivotal point right now with other countries actively trying to attract the same companies and investors and it would be unforgivably complacent to think that we don’t need to do the same. This is a once-in-a generation opportunity and if we don’t seize it now, we will miss out not just on cheaper, cleaner energy but on the huge boost to our economy such investment will bring in terms of growth, jobs and other benefits.”