UK retail sales start to rebound in May following record drop

UK retail sales began to rebound in May, exceeding expectations by rising 12 per cent month-on-month following a record plunge in April, with the proportion spent online hitting a record high.

With fuel excluded, retail sales climbed 10.2 per cent month-on-month, data from the Office for National Statistics (ONS) showed.

The reading had been expected to rebound 6.3 per cent in May after retail sales tumbled a record 18.1 per cent in April, and 15.2 per cent excluding fuel.

Despite the rise posted in May, sales were still down 13.1 per cent compared to February, before the impact of the coronavirus pandemic.

“May’s recovery in retail sales should not be interpreted as a sign that the economy is embarking on a healthy V-shaped recovery from Covid-19,” said Pantheon Macroeconomics’ Samuel Tombs.

He added that household incomes “likely won’t spring back as the economy gets moving again over the coming months”, with the winding up of the coronavirus job retention scheme set to hit incomes as some of the nine million workers on furlough are let go or have their hours cut.

Before the Open newsletter: Start your day with the City View podcast and key market data

Year-on-year retail sales growth climbed to -13.1 per cent, from -22.7 per cent in April, exceeding the consensus forecast of -16.4% per cent.

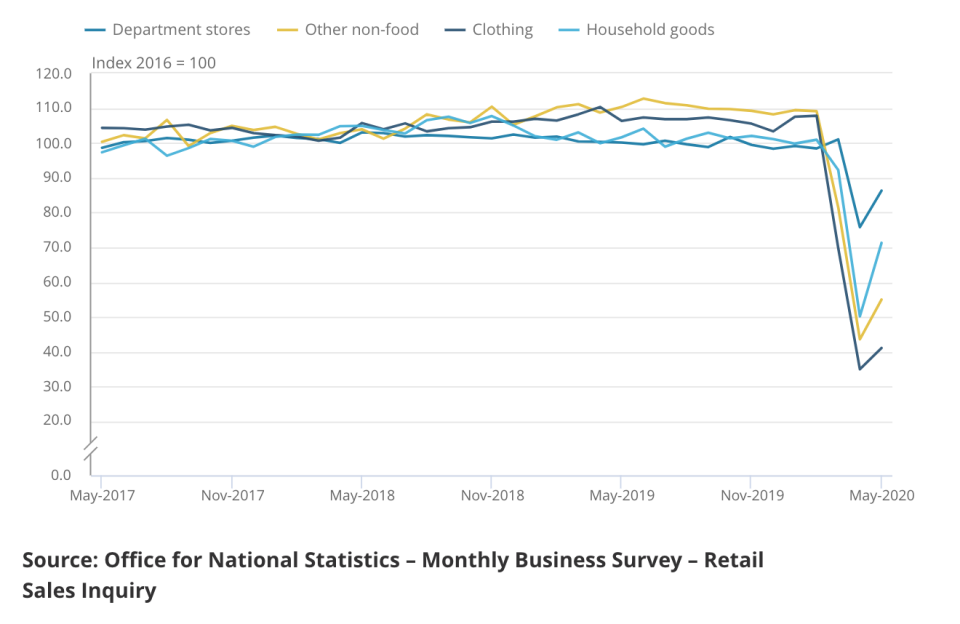

Non-food stores provided the biggest boost to monthly sales in May, with household goods stores recording a 42 per cent increase in sales as hardware stores began to reopen following the lockdown.

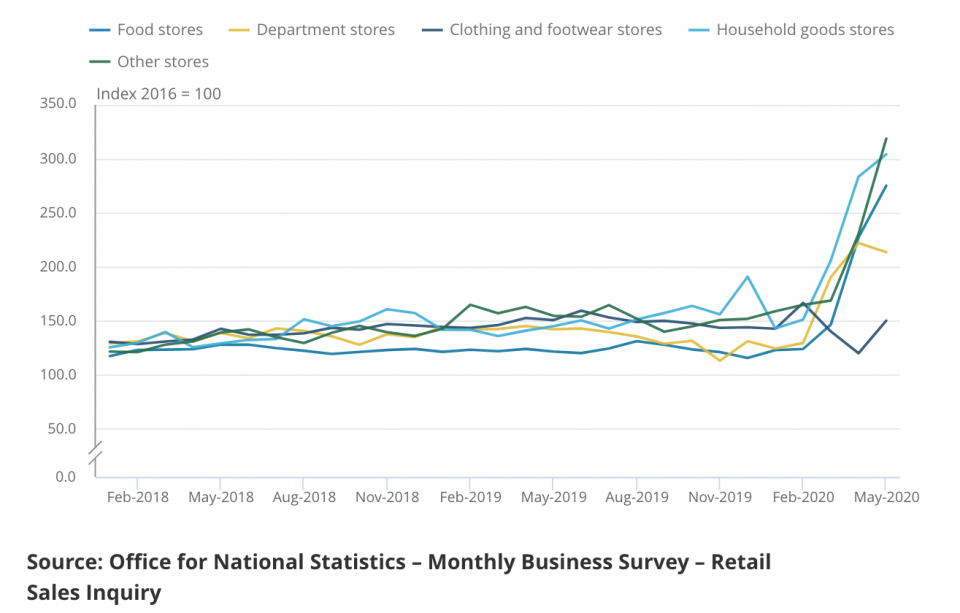

The proportion of spent online soared to a fresh record high of 33.4 per cent in May, rising from 30.8 per cent in April.

“Given the wholesale shifts in consumer behaviour these last few months, it would be optimistic to assume shopping habits will return to normal in the immediate future,” said Lynda Petherick, head of retail for Accenture UK.

“The industry remains in survival mode,” said Richard Lim, chief executive of Retail Economics.

“Our research showed 8 in 10 retailers are considering making redundancies while half are considering store closures in a range of cost-saving measures,” he continued.

“As the Government begins to withdraw support for businesses and households, the true cost of the pandemic will begin to emerge.”