UK recession risk just got a whole lot lower after inflation undershoot

From the Bank of England to recession warnings, Jack Barnett gets under the skin of Britain’s economy in his weekly column

Bank of England Governor Andrew Bailey would not have been the only person in the City last week breathing a sigh of relief after the better than expected inflation numbers.

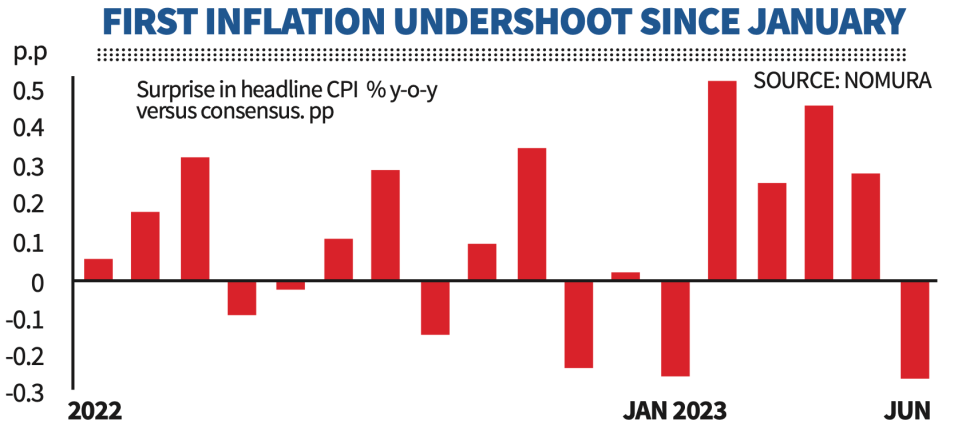

It was the first time the Office for National Statistics’ calculations have undershot analysts’ forecasts since January’s numbers. It was also the first time the Bank has nailed its own projections in ages.

Just six of the last 18 inflation prints have come in lower than market expectations, according to calculations by investment bank Nomura.

What a nice way to sign off for the summer holidays.

Lifting the bonnet on the data extracts yet more good news. Core inflation slipped to 6.9 per cent, below an expected fall to 7.1 per cent.

Declines in global commodity prices are finally feeding through to prices, most notably in food cost growth slipping, although the rate is still very high at over 17 per cent.

Petrol prices also yanked headline inflation lower, signalling supermarkets and other forecourt operators are finally handing over savings to customers (perhaps due to intense government pressure).

Businesses are now playing a greater role in taming inflation, which could weaken the pressure on the Bank to lean on demand with sharp rate rises. About bloody time.

But don’t read too much into one set of data. To conclude that the cost of living crisis has turned a corner, there needs to be yet further good news.

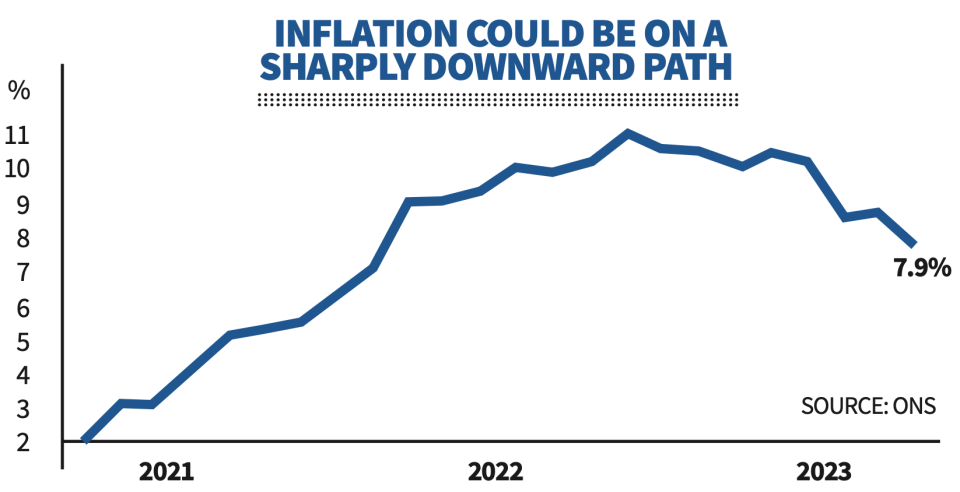

Part of the reason why inflation has hugged closer to eight and nine per cent while European and US rates have stepped lower is due to the state energy regulator Ofgem only changing its price cap every three months.

July’s inflation calculation will incorporate the lower £2,074, helping to pull inflation possibly below seven per cent.

More timelier economic indicators have pointed toward deflationary pressures gathering momentum.

Research firm Kantar’s latest estimate of grocery price growth fell to around 14 per cent in July, while recent purchasing managers’ indexes show input costs are rising at the slowest pace in over two years.

Under reported last week was the ONS estimating the cost of components used by factories to make products falling 2.7 per cent over the year to June.

All this points to a downsized recession risk in the UK, a judgement that has oscillated seemingly with every new set of economic data from the ONS.

The looming hit to mortgagors that will play out from the second half of this year and last until at least 2025 could be blunted by markets buttering the Bank of England up for fewer interest rate rises.

Peak rate expectations have fallen to 5.75 per cent from 6.25 per cent. Moneyfacts data shows banks have already responded to that climb down by lowering rates on 2-year and 5-year deals.

That should smooth what has already been a shallower than projected knock to incomes. According to the Resolution Foundation, living standards fell just 1.8 per cent over the last year compared to the Office for Budget Responsibility’s 3.8 per cent projection, a difference of £28bn.

Though consumer spending will invariably drop, the slide may be flatter, arresting higher unemployment and lower economic growth.

However, another sizable dent to inflation is required to justify the conviction that it has finally been defeated. One good reading does not make a trend.

As Nomura pointed out, monthly services prices are still rising faster than their long term average. Wages are also accelerating quickly at 7.7 per cent in the private sector.

It would be stupid for Bailey and the rest of the MPC to leverage one set of numbers to determine their next rate decision.

Instead, they will focus on the data as a whole. Though less likely, don’t be surprised if they opt to repeat a larger 0.5 percentage point rate increase on 3 August.

Just as people cautioned one piece of hotter than feared inflation data shouldn’t spark doom and gloom, one piece of good data needs to be welcomed with caution.

WHAT I’M READING

Beijing is very clearly getting worried about the health of the Chinese economy. In the readout from its latest Politburo meeting, the word risk was mentioned seven times, up from three times in April, as Julian Evans-Pritchard, head of China economics at Capital Economics. Domestic consumption is fraying. The property sector is teetering. Record high youth unemployment is a worry. All this is translating into underperforming growth in the world’s second largest economy. GDP expanded 6.3 per cent in the second quarter on an annual basis, but growth was much slower at 0.8 per cent when compared to the first quarter.