UK public sector borrowing falls in October

In October the UK public sector borrowed £8.1bn – £200m less than in October 2012. October's figure puts the public sector net debt pile at £1.207 trillion, equivalent to 75.4 per cent of GDP. The Office for National Statistics (ONS) reported that public sector net borrowing was £115bn in 2012/13, 3.5bn lower than in 2011/12.

(ONS)

The improvement in public finances ensures that the government remains on track to significantly undershoot its current fiscal target for 2013/14, says Howard Archer, chief UK and European economist at IHS Global Insight.

The chancellor must be feeling an awful lot happier about life now than when he was preparing hiss Autumn Statement last year.

He is likely to be in the happy position of announcing markedly increased GDP growth forecasts for 2013 and 2014 at least from the Office for Budget Responsibility in his Autumn Statement and also significantly reduced public sector deficit projections.

He'll also have some room to manouevre on policy in his Autumn Statement, but he is highly likely to largely stick to his fiscal stance, arguing that it has served the country well and it would be a major mistake to change course. The main headline-grabbing moves in the Autumn Statement may be related to trying to limit energy bills and perhaps some more infrastructure investment initiatives.

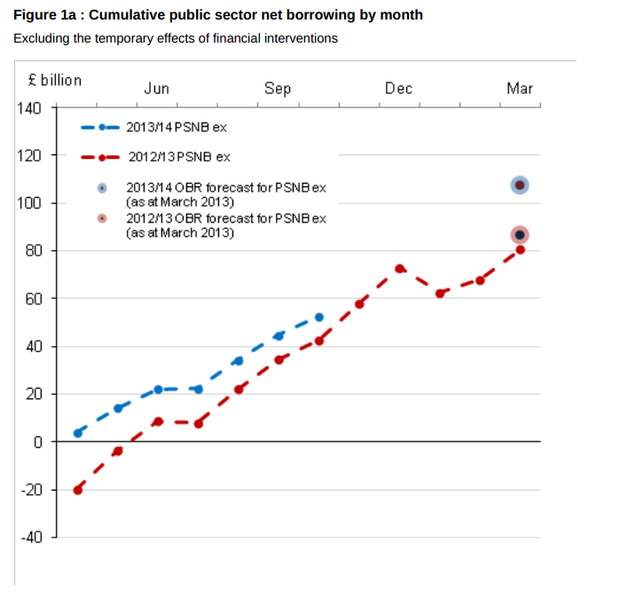

The figures exclude one-off impacting factors, including the transfers from the Royal Mail Pension Plan and the Bank of England Asset Purchase Facility Fund. Excluding the temporary effects of financial interventions, net borrowing in 2012/13 was £80.6bn – £37.9bn lower than 2011/12, when it was £118.5bn.

In October of this year, the £2bn received in cash from the sale of Royal Mail shares did not reduce net borrowing, and the award of just over ten per cent of shares to eligible employees increased it by £300m, said the ONS.