UK on course for slow burning recession, KPMG predicts

The UK economy is on track to enter a long recession sparked by households and businesses being squeezed by sky high price rises, new forecasts out today unveil.

Gross domestic product (GDP) will shrink 1.3 per cent next year, according to consultancy KPMG, who have become the latest organisation to warn of a protracted slump hitting Britain.

The output hit will be mainly driven by households cutting spending in response to raging inflation eroding their pay.

KPMG reckons the rate of price increases will average seven per cent next year, an upward revision from 5.6 per cent in their previous forecasts.

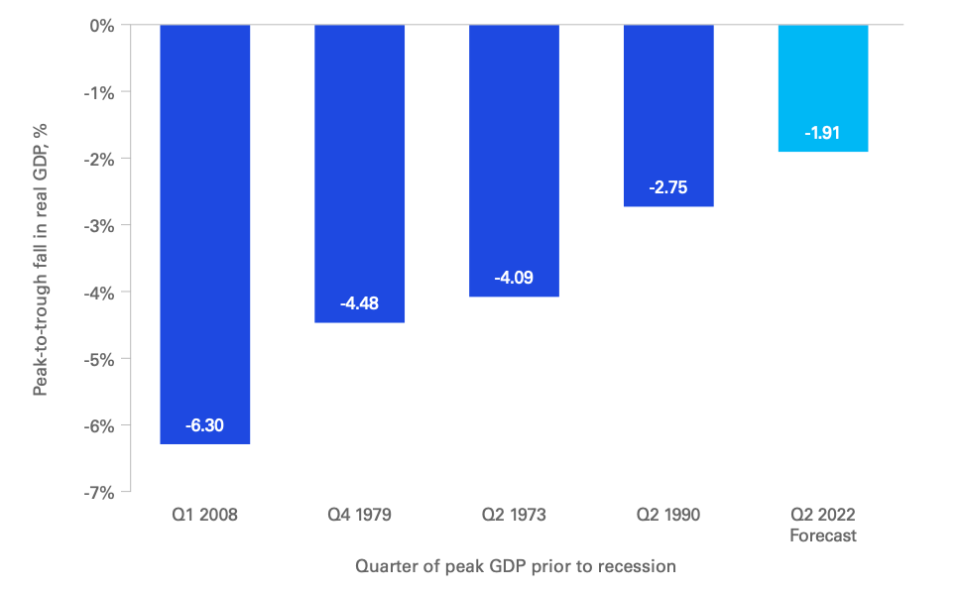

The looming recession is much smaller than previous ones. KPMG thinks the economy will lose nearly two per cent of GDP, peak to trough, compared to the more than six per cent fall in the aftermath of the 2008 financial crisis.

Coming recession will be shallower than previous ones

This year’s inflation surge, initially driven by supply chain breakdowns and then turbocharged by Russia’s invasion of Ukraine roiling international energy markets, has seen prices jump 10.7 per cent.

Economists now however think inflation peaked in October when the rate hit 11.1 per cent. But KPMG thinks the surge in prices will extend into next year, wiping out pay growth.

The bet reinforces predictions by the spending watchdog, the Office for Budget Responsibility, who last month predicted living standards will drop 7.1 per cent over the next two years, the biggest fall since records began in the 1950s.

Yael Selfin, chief economist at KPMG UK, said: “The increase in energy and food prices during 2022, as well as higher overall inflation, have significantly reduced households’ purchasing power.”

“Rising interest rates have added another headwind to growth,” she added. Last week, the Bank of England knocked rates 50 points higher for the ninth time in a row to 3.5 per cent, the steepest rate since the financial crisis.

The likes of the OBR, Bank, IMF and now KPMG all think the economy is hurtling toward a slow burning recession, although bets on how much it will wipe off GDP vary.

The Bank thinks the hit to the UK economy could be near three per cent, while others reckon it will be around 1.5 per cent in size.

A slow down in consumption will prompt businesses to shed workers to protect their finances. KPMG said unemployment is set to peak to 5.6 per cent in the middle of 2024, meaning nearly 700,000 will lose their job.

But, the big four accountant predicted the Bank will stop raising rates at four per cent, about 0.5 percentage points lower than market expectations.

Nonetheless, governor Andrew Bailey and the rest of the monetary policy committee’s rate hiking campaign has cooled the housing market by pricing prospective buyers out of the market by raising mortgage rates.

KPMG said prices may drop over eight per cent, peak to trough, due to slump in demand. The Bank last week projected some 4m homeowners are on track to suffer a £3,000 jump in mortgage bills when they refinance, adding to the real income squeeze.