UK manufacturing activity plunges to seven-year low as economic slowdown bites

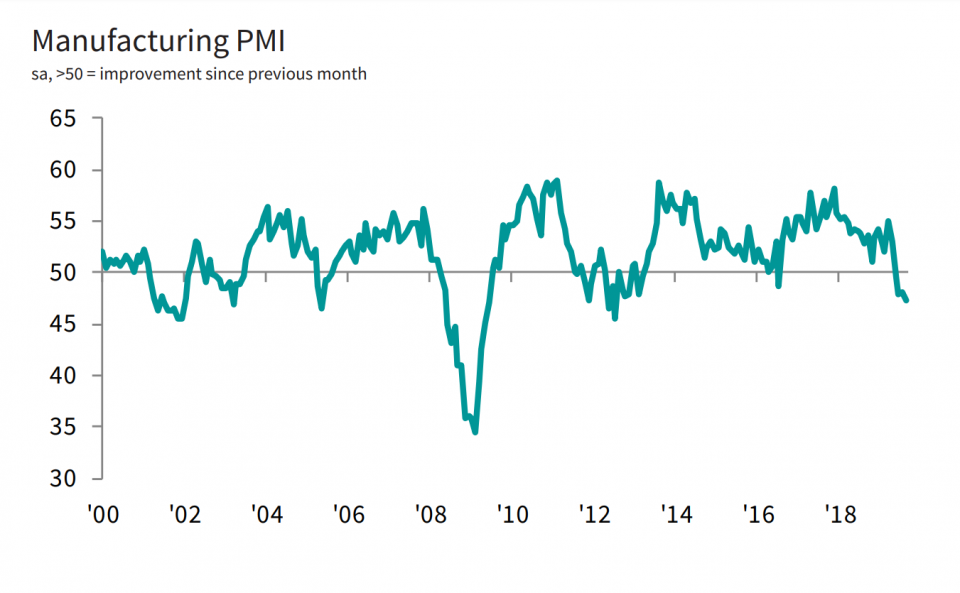

UK manufacturing output crashed to a seven-year low in August as Brexit doubts intensify and a wider economic slowdown hurts firms, according to a closely followed measure of sector activity.

Manufacturing output plunged to its worst level since 2012 last month, according to IHS Markit’s Purchasing Managers’ Index (PMI).

Read more: Toyota to halt production at UK factory day after Brexit

Economists recorded a drop to 47.4 PMI, where anything below 50 represents a contraction.

“High levels of economic and political uncertainty alongside ongoing global trade tensions stifled the performance of UK manufacturers in August,” Rob Dobson, IHS Markit director said.

“Business conditions deteriorated to the greatest extent in seven years, as companies scaled back production in response to the steepest drop in new order intakes since mid-2012.”

The output was consistent with a quarterly contraction of around two per cent, IHS Markit warned.

Sterling dropped even further against the dollar as the news came out, falling 0.55 per cent to 1.2089.

Market watchers warned it could sink below 1.20 “because there is no clarity whatsoever when it comes to Brexit”.

“The drop in the UK’s manufacturing sector was at the fastest pace since 2012 and this is going to only become worse if lawmakers don’t get their act together,” Think Markets chief analyst Naeem Aslam said.

Optimism falls to series-low

Business optimism slumped to its lowest level since researchers began asking firms about their expectations for future output in 2012.

The gloomy outlook has stemmed from weakening market conditions, signs of a global economic slowdown, Brexit uncertainty and subsequent knocks to client confidence.

However, manufacturers still expect to see some output growth over the coming year, as highlighted by 40 per cent of companies forecasting expansion compared to only 13 per cent anticipating a decline.

British factories also shed staff last month amid fears of a no-deal Brexit. The report said manufacturing employment fell at one of the fastest rates over the last six-and-a-half years in August.

“Job cuts were driven by cost saving initiatives (including reorganisations and redundancies), slower economic growth and the continued impact of Brexit uncertainty.”

‘Significant disappointment’

Lloyds Bank Commercial Banking’s head of large corporates manufacturing Steve Harris said: “Further contraction in activity is a significant disappointment for the sector.

“The operating climate remains challenging. UK manufacturing’s exposure to the world economy has been one of its key strengths, but reduced global demand resulting from continued geopolitical uncertainty has created headwinds for export-led strategies.

“On the home front, meanwhile, the question mark over the UK leaving the EU means some manufacturers continue to plan for a number of eventualities, placing pressure on working capital.

Capital Economics analysts said that although the figures suggested the industrial sector was contracting, “we doubt that manufacturing will pull the overall economy into recession”.

“Given the ongoing struggles of global manufacturing and the strong possibility of a no deal Brexit in two months’ time, it is hardly surprising that both domestic and external demand are suffering,” analysts added.

Meanwhile Danske Bank said Brexit had acted as a supply shock.

Eurozone factory slump continues through August

Meanwhile on the continent, manufacturing activity contracted for the seventh month in August as optimism was suppressed by a continued fall in demand.

The Eurozone PMI score came in at 47 – better than July’s 46.5 but still well below the threshold for growth. The results makes it more likely that the European Central Bank goes ahead with monetary easing next week.

The ECB all but promised to ease policy further at their July meeting, as the bloc’s growth outlook gets worse. A further escalation in the US- China trade war yesterday has increased fears of a global economic slowdown, which would hit Europe’s already embattled manufacturers hard.

Read more: UK manufacturing sector ‘suffocating’ as output falls to seven-year low

“Eurozone producers are suffering as the summer slump in factory production persisted into August. A marked deterioration in optimism about the year ahead suggests companies are expecting worse to come,” noted IHS Markit chief business economist Chris Williamson.

New orders fell for an eleventh month, and firms continued turning to completing backlogs of work to stay active.