UK joblessness falls to 1970s low, but pay continues to plummet

UK joblessness has slid to its lowest level since 1974, but scorching inflation is still wiping out Brits’ pay, official figures published today reveal.

The proportion of people out of work dropped to 3.6 per cent in the three months to July, according to the Office for National Statistics (ONS).

Despite the historic low unemployment rate, the jobs market is exhibiting signs of underlying fragility.

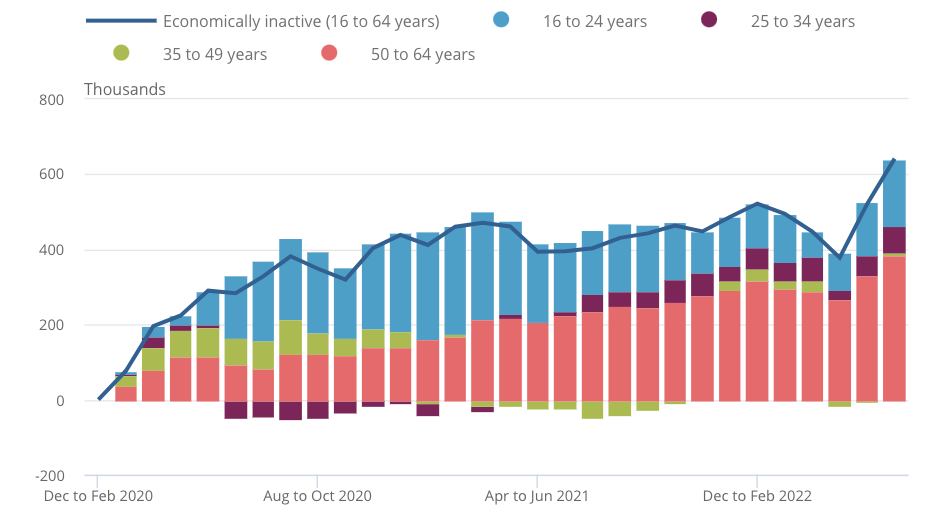

The volume of working age people not looking for a job surged to its highest level since 2015, scaling to more than nine million, which has driven the unemployment rate lower.

UK economic inactivity has surged since the start of the Covid-19 crisis

The ONS does not measure people who are not actively seeking work in its unemployment calculations. If it did, the rate would be higher.

Long-term sickness linked to Covid-19 and NHS backlogs delaying care has driven the economic inactivity level higher, as has a rise in the number of students.

Spending power fell at one of the fastest paces since records began, dropping 2.8 per cent in the last quarter.

New inflation figures out tomorrow are expected to bump higher than July’s 10.1 per cent reading.

The UK’s ailing economy is beginning to cool demand for workers as firms readjust to a weaker trading environment.

Growth in the number of people in work slowed to 39,000 in July, down from a 160,000 rise in June.

“Labour demand is barely rising,” Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said, adding the volume of available workers shrank over 36,000 over the last three months.

“We think that labour demand will continue to soften as the economy falls into recession,” Ruth Gregory, senior UK economist at another consultancy Capital Economics, said.

Britain is expected to tip into a drawn-out recession starting this winter, driven by households and businesses responding to soaring energy bills by cutting spending.

The economy grew 0.2 per cent in July, slower than analysts’ expected, the ONS said yesterday, raising fears the country may be in the early stages of a downturn now.

The additional Bank Holiday for the Queen’s funeral may trigger a technical recession, defined as two consecutive quarters of growth.

Prime minister Liz Truss’s £150bn energy support package in which bills will be frozen at £2,500 for two years will prevent the worst living standards shock on record. She is set to outline the cost of the package at a mini budget next week.

Strong wage growth caused by a shortage of workers forcing businesses to hike pay to attract and retain staff is putting upward pressure on inflation.

As a result, the “Bank of England still has much more work to do,” Gregory said, adding the central bank will lift rates 50 basis points at its meeting next Thursday.

Wall Street titan Bank of America said today governor Andrew Bailey and co will lift rates by that increment at each of its next three meetings and send them to a peak of four per cent next year.