UK isn’t alone in this recession merry-go-round – just look at Europe

It’s worth remembering that Britain isn’t some sort of pariah in the rich world that’s undergoing a tough economic slump, which is threatening to extend the growth slow down since the 2008 financial crisis.

Europe’s major economies, led by Germany, its powerhouse, are also in the teeth of a slump.

Numbers out last week revealed the bloc’s biggest economy’s industrial sector, which it relies on to generate a big chunk of its output, shrunk 3.4 per cent in March, a much steeper fall than expected by analysts and a reversal from a more than two per cent increase in February.

That batch of data led economists to roundly agree Germany is on the brink of a recession, which Britain has also seemingly been flirting with for months and months.

In fact, production across the 20 members that make up the eurozone, the common currency area, is trending in line with Britain.

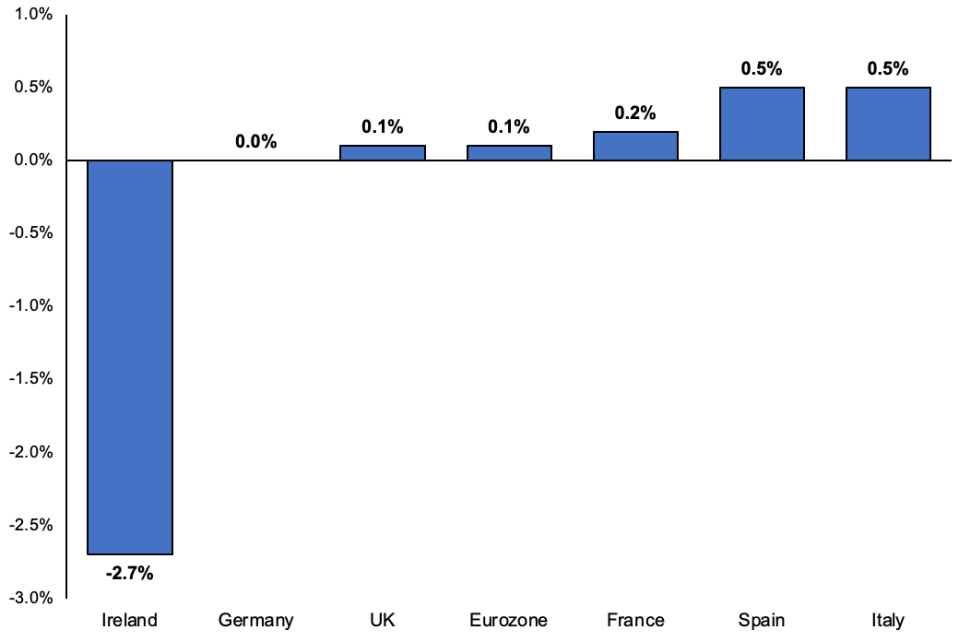

Gross domestic product – a measure of goods and services an economy makes – grew just 0.1 per cent in the first three months of this year in the eurozone, the same as the UK’s first quarter figure.

Germany’s economy stagnated after shrinking 0.5 per cent in the final months of last year, meaning they woul slip into a recession if Eurostat – the stats agency that produces the continent’s main economic data – revises its estimate lower.

France grew 0.2 per cent; Italy 0.5 per cent; Spain 0.5 per cent and Ireland contracted 2.7 per cent.

In sum, not wholly good.

The dynamic that has shredded UK growth over the last year, and probably next, shares similarities with that which is sweeping through Europe.

Energy prices jolted higher after Russia sucked gas out of international markets in response to sanctions slapped on it in retaliation for its full-scale invasion of Ukraine. That made large swathes of business activity in Europe unviable, crimping output.

UK and European Q1 GDP growth was sluggish

European consumers have also been squeezed by a historic inflation surge – peaking at more than 10 per cent in October – sparking a spending slow down.

The European Central Bank, much like the Bank of England, has responded to that price surge with aggressive interest rate rises, sending them to 3.25 per cent and is expected to keep heaping pain on businesses and families in the coming months. The former is tipped to maybe back two more rate increases. The Bank may have one more rise in it.

Eurozone banks have also reined in lending sharply in response to US banking failures, adding to the squeeze on firms.

Sound familiar?

Both the UK and Europe dodged the dire predictions of blackouts and a tough recession tabled in the months after Russia’s invasion of Ukraine.

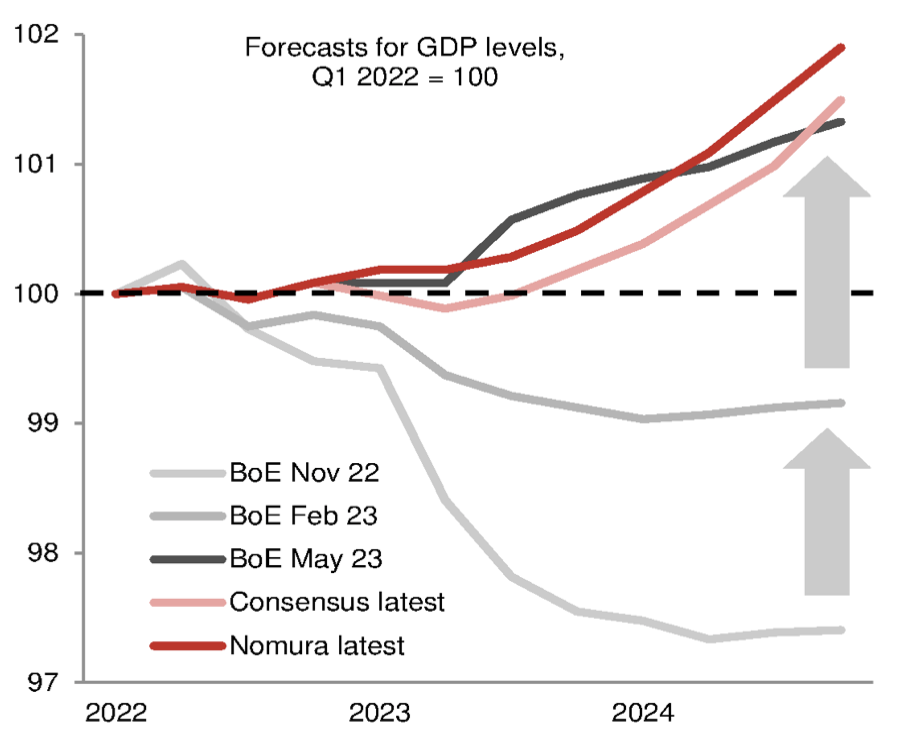

And now Britain’s economic prospects are looking a damn lot better compared to just a few months ago, if one takes the Bank of England’s word for it.

Governor Andrew Bailey and co last week upgraded GDP by the greatest amount (about two per cent) since the central bank was made independent in 1997. It had expected the longest recession in a century not too long ago.

Similarly, the European Commission yesterday raised its expectations for GDP growth across the bloc – up to 1.1 per cent and 1.6 per cent this year and next.

Stronger than expected demand and persistent price pressures concentrated in the food production sector mean inflation this year will be higher than the Commission previously predicted at 5.8 per cent, up from 5.6 per cent.

What ties assessments of the UK and European economies – which, under the same pressures, have moved more in tandem than one might have thought – is that they have been overly pessimistic.

Experts over-baked their recession warnings, justifiably so because of the huge energy price shock that at the time looked set to sweep through households and businesses’ finances. Energy prices have come down markedly over the last few months, prompting the recent round of forecast reversals.

Bank of England has consistently hiked its GDP predictions

Compare two passages from the Commission and Bank’s new projections, starting with the former, each of which explain why they lifted their GDP outlook.

“Lower energy prices, abating supply constraints,improved business confidence and a strong labour market underpinned this positive outcome.”

“This reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility of lower precautionary saving by households than previously assumed in turn related to a lower risk of job loss.”

Hard to tell the difference, isn’t it?

Both the UK and Europe are now on the path to avoiding a recession. It’s worth remembering to take a look at our European neighbours before wrongly concluding that the UK is somehow alone on the recession merry-go-round.

YOU MIGHT HAVE MISSED

A combination of two government support schemes ending shoved business investment up more than one per cent in the UK in the first three months of the year. The conclusion of the Help to Buy and super deduction schemes meant firms front-loaded real estate and IT spending, ONS numbers last Friday showed.

WHAT I’M READING

Interest rates may fall faster than the market expects to three per cent rather than the four per cent priced in by the end of next year. That’s according to consultancy Capital Economics. The odds are very finely balanced on whether the Bank of England will raise borrowing costs again at its next meeting on 22 June after last week’s twelfth straight hike.