UK inflation will drop back to Bank of England two per cent target by end of this year, economists predict

Inflation in the UK is on track to fall exactly back to the Bank of England’s target by the end of this year, according to forecasts by two top City of London economists.

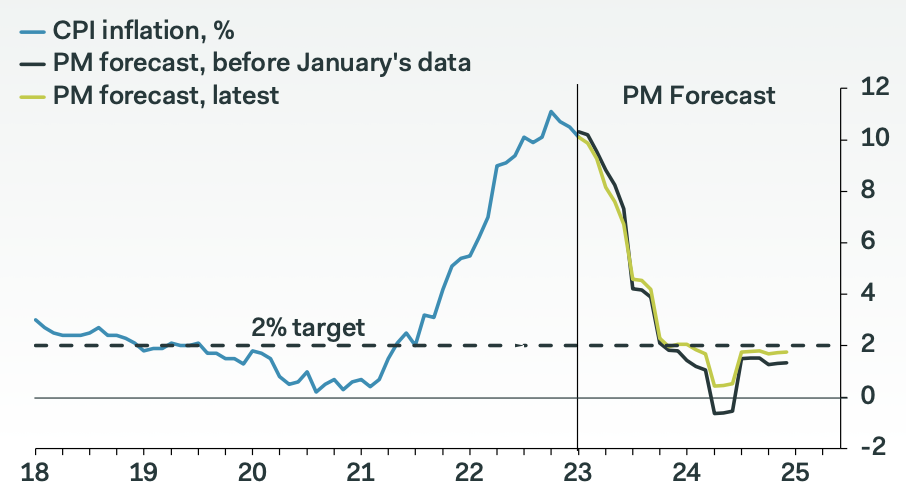

The rate of price increases will tumble to two per cent in the final three months of 2023, according to Pantheon Macroeconomics.

By November, the firm reckons the cost of living could even tip just below the two percent threshold to 1.9 per cent before bumping up two per cent in December.

A colossal unwinding in international energy prices after they surged to record highs last summer, pushed higher by Russia’s invasion of Ukraine rocking global oil, gas and electricity prices, is poised to drive UK inflation rapidly lower this year.

Bank of England economists are less optimistic about the inflation outlook, forecasting it will more than halve to around four per cent by Christmas, still more than double their two per cent target.

Separate projections by investment bank Citigroup chimed with Pantheon’s predictions. They suspect inflation is on track to slip to 2.3 per cent in November.

If the pair’s bets do play out, it would unfold one of the fastest inflation declines ever, stumbling from a peak of 11.1 per cent in October. The rate has already dropped for three straight months to 10.1 per cent.

Britain is on the brink of slipping into a recession, ignited by households and businesses responding to inflation eroding their finances by cutting spending, which should put downward pressure on prices.

Bank governor Andrew Bailey and co’s 10 successive interest rate rises to a 15-year high of four per cent to quash prices has also chilled economic activity.

Inflation is on course for a huge fall in 2023

Last November, the Office for Budget Responsibility (OBR) warned the amount of money Chancellor Jeremy Hunt would spend on capping typical household annual energy bills of £2,500 would nearly top £13bn

But the sudden steep fall in international energy prices means the government could spend around half that, handing cash back to Hunt to potentially use at the 15 March budget, although some of that fillip will be offset by lower revenues from the energy windfall tax.

A faster than expected inflation drop is set to lower government spending on servicing the UK’s debt pile, which is nearly 100 per cent of GDP. A big chunk of the debt stock is tied to the retail price index, an old measure of inflation.

Hunt has repeated he is not prepared to cut taxes or raise spending next month for fear of missing the government’s fiscal rules, namely, getting debt as a share of the economy and making sure borrowing does not top three per cent in five years.