UK industry is modern, high-tech and a good bet for savvy investors

Funds and ETFs can help get you exposure to an area that promises to flourish, writes Phil Thornton

Barely a day goes by without a new portent of doom and gloom for some part of the UK economy, whether for financials, retailers or housebuilding.

But one sector may offer a glimmer of hope during a period of falling house prices, a credit crunch and a consumer recession – good old-fashioned British industry.

Except that modern UK manufacturing is anything but old fashioned. Mass production and metal bashing have disappeared to be replaced by aerospace, high-tech engineering and pharmaceuticals to name three.

The sector is certainly smaller than in the past. Manufacturing, as defined by the Office for National Statistics, makes up 14.7 per cent of economic output now compared with 20.9 per cent in 1997.

It also employs a million fewer people than it did a decade ago, but crucially those who still work in manufacturing are highly efficient.

Niche Areas

Manufacturing productivity is growing by 2.6 per cent a year compared with just 0.6 per cent for the economy as a whole and has grown by 50 per cent since 1997.

This is the result of globalisation, which forced companies to find high value-added niche areas, and the strength of sterling, which forced them to cut costs.

The sector has benefited from the pound’s fall against the euro, which has made our goods cheaper to Continental buyers and many believe it is well-placed to take advantage both of the current boom in emerging markets.

Exports rose for a fifth month running (by 0.7 per cent) in May, official figures showed, suggesting the weaker pound is helping UK exporters. Industry may also benefit from government support in the form of tax reliefs, given the Government’s vocal support for the sector.

Speaking at a roadshow to support UK industry this month, Shriti Vadera, the business minister, described it as the “unsung success story of our economy”.

Smaller and Swifter

Justin Urquhart Stewart, founder of Seven Investment Management, said the fact the news was not “uniformly dreadful” elsewhere in the market meant this sector might offer some opportunities.

“We are no longer the world’s metal bashers but have much smaller companies that understand they need to be swifter on their feet,” he said.

He said Britain had done well to specialise in areas dependent on R&D and technology. He likes Cobham, the avionics and electronics company, and Rolls-Royce, the aeroengines giant, which are well positioned to take advantage of the growth in both civilian and defence aerospace.

Investors who would rather stick to the safety of a mutual fund need to carry out careful research, as there is no major fund that concentrates solely on the sector.

Mark Dampier, head of research at Hargreaves Lansdown, an independent financial adviser, highlights the £490m UK Alpha Fund run by New Star Asset management.

“They have had good performance against a market that has cratered,” he says. “The fund managers who have done well have picked domestic manufacturers focused on overseas markets which are growing.”

Aerospace and Defence

The UK Alpha Fund has 15 per cent of its holdings in aerospace and defence and another 13 per cent in industrial engineering. It has almost 4 per cent in Babcock Engineering, which refits the Royal Navy’s nuclear submarines, and in BAE Systems.

In the year to 31 March it posted a loss of 4.0 per cent compared with a 19.7 per cent FTSE All-Share index fall.

Mick Gilligan, head of research at Killick & Co, the stockbrokers, says companies with strong balance sheets and consistent earnings potential will benefit over the medium term.

He is cautious about jumping onto the defensive growth bandwagon just as the wider market looks ripe for a rebound and warns that the slowdown in the eurozone economy will hit demand for UK exports.

For determined investors he highlights the AXA Framlington UK Select Opportunities unit trust, which has 29 per cent holding in industrials, including companies such as Rotork, the engineers, and Hunting, the oil and gas services company. He also picks Standard Life Equity Unconstrained, which holds almost half its entire portfolio in industrials and includes companies such as Invensys, Charter and Cookson Group. However Gilligan is worried about the short-term outlook for this sector.

“We have had some numbers coming in below expectations,” he says. “The danger is that it might feed through to this part of the world.”

Official figures for the UK showed a 0.5 per cent contraction in output for May and on Wednesday the CBI’s quarterly survey showed significantly weaker order books and lower foreign demand.

ETF Opportunity

Investors worried by the timing may be tempted by an exchange traded fund (ETF) focused on European industrials being launched next month(AUG).

The Industrial Goods ETF from db xtrackers, part of Deutsche Bank, will be the first to be launched in the UK when it is listed on the London Stock Exchange.

ETFs are open-ended investment funds that invest in a particular equity index. An ETF issues shares to investors, who can trade them during normal trading hours just as they would shares in an individual listed company, thus combining the liquidity of a share with the diversification of a unit trust. They also benefit from low charges and an exemption from Stamp Duty.

More than a fifth of db x-trackers’ ETF is invested in UK industrials and its biggest holdings are BAE Systems, Rolls-Royce, Smiths Group and Wolseley. Manooj Mistry, head of db x-trackers UK, said the fund provided an easy and low cost way for people to invest in industrials.

“You can hold it for one day or for the long-term so it is very flexible,” he says. “If people think industrials are going to do well then they can switch into that sector using our ETF.”

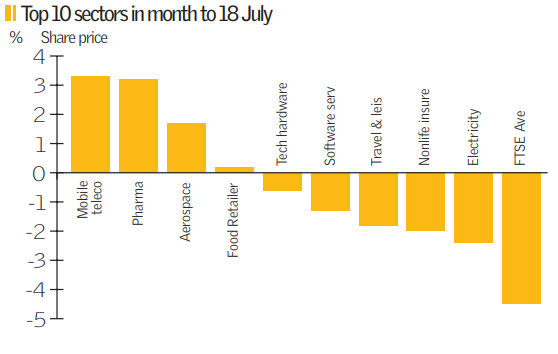

One swallow does not make a summer but pharma and aerospace were in the top three best-performing sectors over the last four weeks. Industrials are overdue their time in the sun.