UK house prices growing at the slowest rate since November 2012

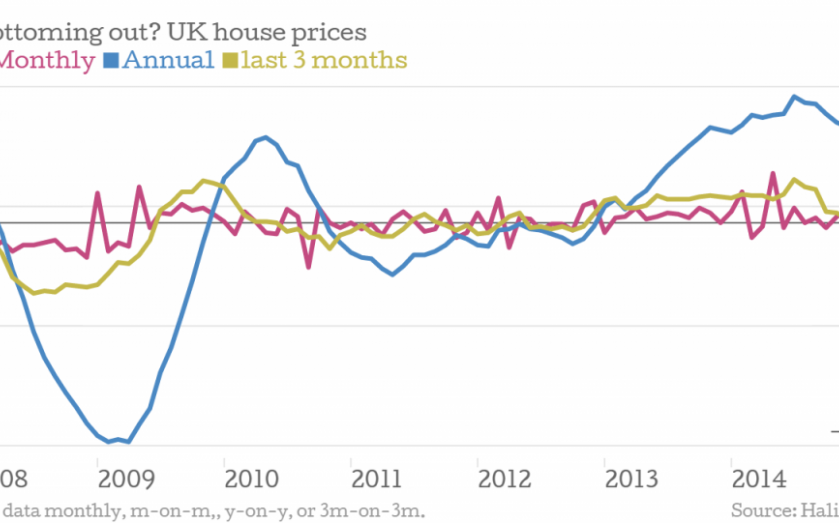

House prices grew by 0.3 per cent in December, their slowest rate since the three months to November 2012, according to data released by Halifax.

Today's data is further evidence of a sluggish housing market in the second half of the year, slowing from a peak of 3.5 per cent for the three months to July.

The numbers

The annual rate of growth also slowed, from 8.1 per cent to 7.8 per cent, the slowest rate of growth since January last year. The latest month-on-month figures showed a slight uptick from 0.5 per cent to 0.9 per cent. This puts the average house price in the UK at £188,858. House sales for December were down to 98,490, falling below 100,000 for the first time since November 2013.

Why it’s interesting

There has been speculation that much of the economic recovery may have been built on debt, with house prices at the centre of the debate. Price to earnings ratios have come under scrutiny as house prices rise much faster than either wages (0.6 per cent for regular wages) or inflation (one per cent).

According to Halifax, price to earnings ratios were at an average of 5:1 in the third quarter of 2014, the first time the measure has gone over 5 since the second quarter of 2008. The Bank of England brought in Mortgage Market Review restrictions, limiting the number of high-end mortgages banks can grant.

London’s house prices, especially, have grown at a rapid rate: annual growth hit 20.7 per cent in the third quarter. There was speculation as to whether the growth would be sustained and, now, whether the slowing of the market will bottom out, or keep going into 2015. There is also the spectre of an interest rate rise from the Bank of England, which may be affecting buyer sentiment.

What Halifax says

Martin Ellis, housing economist at Halifax, said:

The deterioration in housing affordability as a result of rising house prices, earnings growth that has been consistently below consumer price inflation until very recently and speculation of an interest rate rise, have combined to temper housing demand since the summer. The weakening in housing demand has led to a reduction in both price growth and sales in recent months.

We expect a further moderation in house price growth over the coming year with prices nationally predicted to increase in a range of 3 to 5 per cent in 2015. Housing demand, however, should continue to be supported by a growing economy, rising employment levels, still low mortgage rates and the first gain in ‘real’ earnings for several years.