UK house prices drop due to ‘affordability pressures’ and soaring mortgage costs

UK house prices dropped by 0.4 per cent in April last month, as ‘affordability pressures’ including soaring mortgage costs deterred Brits from buying.

Nationwide’s latest House Price Index showed that while the cost of a property fell month-on-month, the annual rate of change slowed too, to 0.6 per cent, from 1.6 per cent in March.

The average price of a house in April was at £261,962, up from £261,142 in March in figures which are not seasonally adjusted. Average London house prices are typically double the UK average.

Robert Gardner, Nationwide’s Chief Economist, said: “UK house prices fell by 0.4 per cent in April, after taking account of seasonal effects. This resulted in a slowing in the annual rate of house price growth to 0.6 per cent in April, from 1.6 per cent the previous month.”

He also said that “the slowdown likely reflects ongoing affordability pressures, with longer-term interest rates rising in recent months, reversing the steep fall seen around the turn of the year”.

“House prices are now around four per cent below the all-time highs recorded in the summer of 2022, after taking account of seasonal effects,” the chief economist added.

This comes as the Bank of England considers when it will start cutting interest rates in response to falling inflation. The Federal Reserve in the United States is meeting today to make its decision, with most analysts expecting a hold, and most experts in the UK not expecting a cut in rates until later in the summer.

Last month, it was reported that house prices fell one per cent in March, according to the latest data from Halifax, while other data suggested more and more Brits are using friends and family to borrow cash, in order to get a mortgage.

Earlier this week, in the latest reading from property portal Zoopla, it was revealed that higher-than-average mortgage rates and stamp duty are behind falling prices in the capital.

As house prices continue to soar in the capital, millions have stayed in the rental market. Average advertised rents in London are now 5.3 per cent higher than last year.

Gardner added that “recent research carried out by Censuswide on behalf of Nationwide found that nearly half (49 per cent) of prospective first-time buyer have delayed their plans over the past year”.

He continued: “Among this group, the most commonly cited reason for delaying their purchase is that house prices are too high (53 per cent), but it is also notable that 41 per cent said that higher mortgage costs were preventing them from buying.”

Lower interest rates would make the cost of borrowing less, and therefore likely to push down the cost of a mortgage at first.

Gardner said: “Coupled with this, 84 per cent of prospective first-time buyers said that the cost of living has affected their plans to buy, for example through having less money each month to save for a deposit. Around two-thirds (67 per cent) of respondents currently have between £0 and £10,000 saved towards a deposit.

“With a 10 per cent deposit on a typical first-time buyer property currently around £22,000, it is not surprising to find that c.60 per cent of prospective buyers have yet to save more than a quarter of their target deposit.”

He added that “55 per cent of respondents said they would be willing to buy in another part of the country where house prices are cheaper, or where they could buy a bigger property. Inevitably, there is a lot of variation in how far people would be willing to move, but half said they would move more than 30 miles from their current location”.

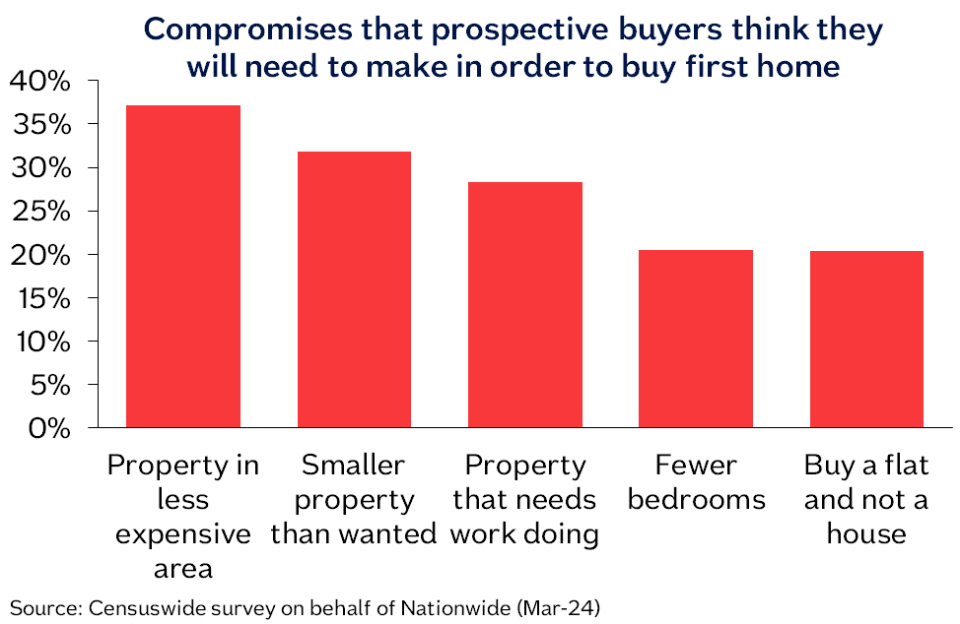

Nationwide’s chief economist continued: “Buying a property in a less expensive area appears to be the most common compromise that prospective buyers will make. Around a third (32%) said they would consider a smaller property than they wanted, while 28% would go for a property that needed work doing.”

“Amongst recent first-time buyers (those who have bought their first home in the last five years), 38% said they ended up compromising on the property they purchased. Among this group, nearly 40% bought a property to do up (rather than ‘turn key’ ready) while 34% bought in a different area.”

With the London mayoral election on Thursday, and a General election looming, parties have been grappling for support on the issue of housing, with Labour in particular committing to building more, including on the so-called ‘grey belt’.

This week Sadiq Khan accused “Tory town halls” of blocking new homes from being built in London and pledged to crack down on housebuilding if re-elected.

Nicky Stevenson of estate agent Fine & Country, said the “market remains highly changeable, with prices up slightly one month then falling back the next”.

She added: “Although demand continues to pick up nicely with mortgage approvals rising, the economy remains in a fragile position.

“Uncertainty over the Bank of England’s base rate decision has led to some major lenders increasing mortgage rates, and this may have a short-term effect on consumer confidence.”

Iain McKenzie, CEO of The Guild of Property Professionals, added that the figures showed “another modest fall in house prices indicates that growth we saw at the start of this year was unsustainable.

“Elevated living costs are still putting pressure on households to control their spending, while also making it more difficult for first-time buyers to save for a deposit.

“Sellers should not be surprised if buyers are looking for more flexibility on price. If you are in a rush to sell, you may encounter offers that are well below your asking price.