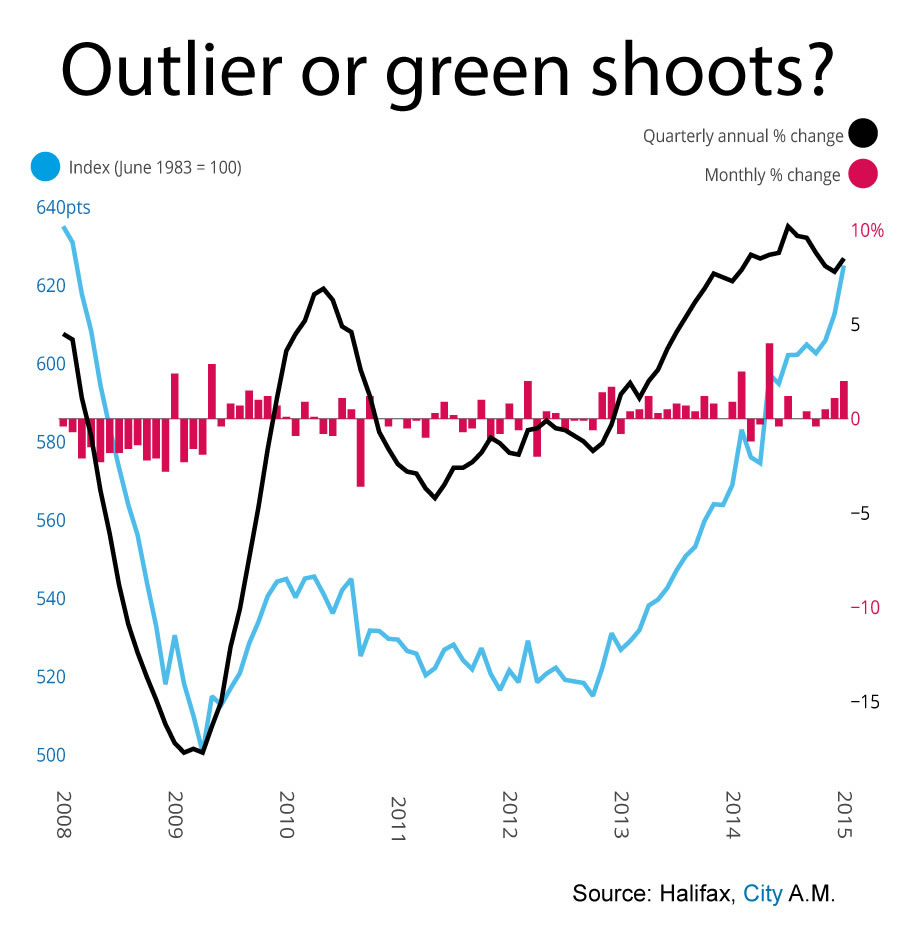

UK house prices come roaring back in January: Mortgage rates, stamp duty or just an outlier?

The night is always darkest before the dawn, but house prices have skipped the daybreak formalities to come bouncing back.

According to Halifax, the figures are bullish: 1.9 per cent quarterly growth hasn’t been seen since September, and the two per cent monthly bounce hasn’t been bested since last February. Annually, and perhaps most reliably, the rate is 8.5 per cent across the UK, the highest growth has been since October. All smiles.

But why the bounce? Howard Archer of IHS Global Insight is not filled with the optimism the figures suggest. He emphasised:

We have little doubt that the spike in house prices in January reported by the Halifax is an outlier

But, nevertheless, he believes the period of weak growth and contraction could be nearing an end.

we do suspect that the weakness in housing market activity may be bottoming out and we see activity picking up to a limited extent in 2015 from current levels. This suspicion is tentatively supported by the Bank of England reporting that mortgage approvals improved to 60,275 in December from November’s 17-month low of 58,956.

Of course, not too much should be read into one month's data and mortgage approvals are still at a low level. Indeed, at 60,275 in December, mortgage approvals were still 20.2 per cent below the 74-month high of 75,557 seen in January 2014.

Halifax believes that, although it is too soon to draw any conclusions, the bounce could be related to stamp duty changes and lower mortgage rates. Martin Ellis, Halifax housing economist, also pointed to other outlying data seen during Januaries past:

These improvements may indicate that the recent declines in mortgage rates, the reform of stamp duty and the first increases in real earnings for several years are providing a modest boost to the market.

It is, however, too early to draw any firm conclusions. The monthly figures in January can be particularly volatile due to the lower volumes of activity at this time of year and there have been unusually large rises on occasion in the past, such as in 2007 (2.3 per cent) and 2009 (2.4 per cent).