UK house prices climb at fastest rate since 2021 – but fears over Budget impact mount

The UK housing market had its best year since 2021 last year, a new survey shows, but economists are concerned that cracks are starting to show.

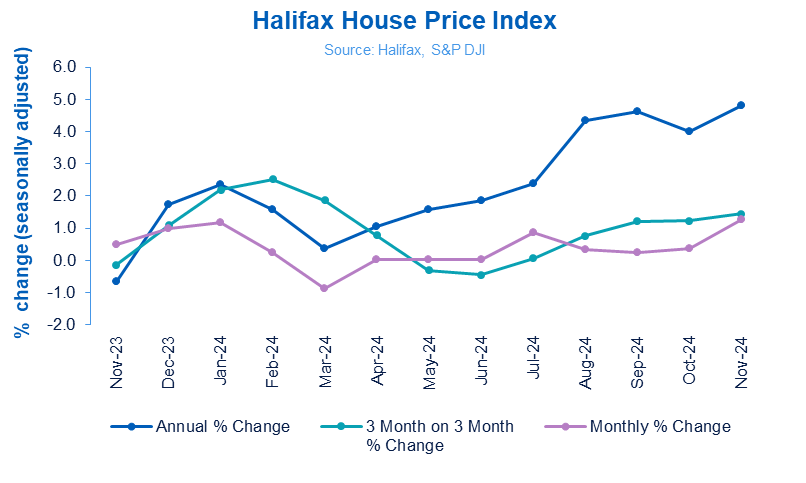

According to Halifax, UK house prices rose 3.3 per cent across 2024 as a whole, with the majority of the house price growth coming in the second half of the year.

Amanda Bryden, head of mortgages at Halifax, said that house price growth had “taken off” from the summer, hitting the highest level in over two years.

“In the latter half of the year, house prices grew in response to the falls in mortgage rates, alongside income growth, both leading to financial pressures somewhat easing for buyers,” she said.

Incoming changes to stamp duty thresholds have also given impetus to the market as first-time buyers seek to avoid the impact of the tax change, Bryden added.

Nevertheless, UK house prices fell 0.2 in December, breaking a run of five consecutive monthly increases. This meant the typical property ended the year costing £297,166.

Many commentators pointed to the impact of the Budget in slowing house price growth.

The Bank of England is likely to cut interest rates at a slower pace than previously expected in 2025 due to the fiscal stimulus announced in October’s Budget.

This has put upward pressure on mortgages, slowing demand. Bank of England data out earlier this month showed that mortgage approvals fell faster than expected in November amid affordability constraints.

Tom Bill, head of UK residential research at Knight Frank, said the impact of the Budget would continue to weigh on the housing market in 2025.

“The current rate of house price growth will come under more pressure as higher borrowing costs triggered by the Budget start to bite,” he said.

Bryden also suggested that a slower pace of interest rate cuts would mean that mortgage affordability “will remain a challenge for many”.

However, a separate survey from Nationwide published last week showed that UK house prices continued rising in December despite slightly higher mortgage rates.