UK house prices: Growth down while rents soar by their highest in seven years

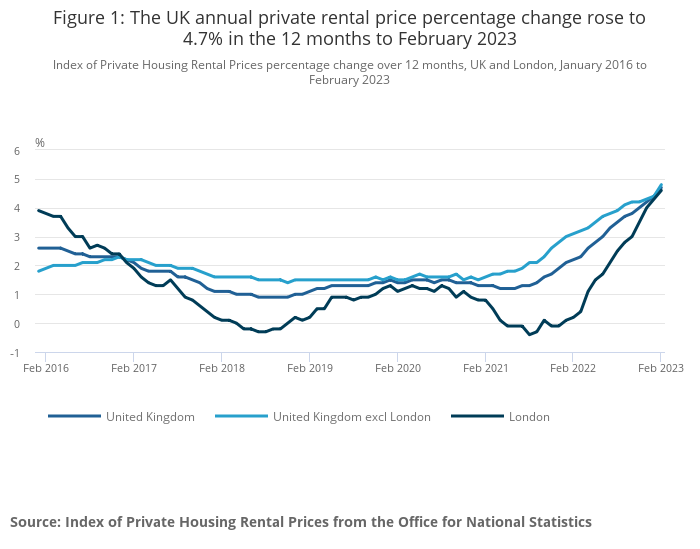

Private rent paid by tenants in the UK rose 4.7 per cent in the 12 months to February 2023, up from 4.4 per cent in the 12 months to January 2023, according to the Office for National Statistics which also reported that house prices increased 6.3 per cent in the same period.

Annual private rent increased by 4.5 per cent in England, 4.2 per cent in Wales and 4.9 per cent in Scotland in the 12 months to February 2023.

The ONS said the UK rise of 4.7 per cent represented the largest annual percentage change since January 2016.

Within England, the East Midlands saw the highest annual percentage change in private rental prices in the 12 months to February 2023, 4.9 per cent, while the West Midlands saw the lowest at 4 per cent

London’s annual percentage change in private rental prices was 4.6 per cent in the 12 months to February 2023.

verage asking rents in London have hit a record £2,480 per month amid fierce competition for properties in the capital, according to property website Rightmove.

In January Rightmove found that the average asking rent in London jumped 15 per cent annually to reach £2,480 at the end of last year, while asking rents in inner London climbed even higher to pass £3,000 for the first time ever, Rightmove said.

While rents in the capital continue to outpace the rest of the country, the average asking rent also jumped 9.7 per cent on a national scale in 2022, with the national average hitting a record at £1,172.

Average house price is now £290,000

Average UK house prices increased by 6.3 per cent in the 12 months to January 2023, down from 9.3 per cent in December 2022.

The average UK house price was £290,000 in January 2023, £17,000 higher than 12 months ago.

Average house prices increased over the 12 months to £310,000 , or 6.9 per cent, in England, £217,000 in Wales , 5.8 per cent, £185,000 in Scotland, 1 per cent and £175,000 in Northern Ireland , 10.2 per cent.

Scotland’s annual house price inflation has generally been slowing since the recent peak of 13.8 per cent in the 12 months to April 2022, slowing to one per cent in the 12 months to January 2023.

The North East saw the highest annual percentage change of all English regions in the 12 months to January 2023, 10 per cent while London saw the lowest at 3.2 per cent.

Nick Leeming, chairman of Jackson-Stops, said that despite economic headwinds, the property market remained “on course”, with only a marginal decrease in house prices reported despite many predicting a more dramatic decline.

“Much of this data reflects the fallout from Autumn’s Trussonomics, where now, as we move into the Spring, we are seeing a much more healthy market with more listings as well as buyers, as people renew their search after putting purchases on hold for longer than usual at the end of last year. Resilience is the new buzz word for housing, with what could be a surprisingly bright summer ahead.

Emily Williams, director of residential research at Savills said, some parts of the UK housing market continued to outperform. She said: “The North East saw a slight increase in average values between December 2022 and January 2023, reflecting the region’s limited exposure to mortgage affordability pressures. Savills expects regions furthest from London, and cash and equity rich markets which are least reliant on borrowing to be the strongest performers over the next five years.

“The data is also starting to show the challenges first-time buyers are facing due to rising borrowing costs. The average price paid by FTBs fell by 1.5% between December and January, but values paid by home movers, who have been able to build up equity through the strong price growth in 2020-2022 and can therefore borrow at lower loan to income ratios, saw a much smaller fall.”

Sarah Tonkinson, managing director of institutional PRS and build to rent at Foxtons, said that there were 20 renters registering per each new property on the market, right across London.

She said: “We are in the midst of an unbelievably competitive first quarter. Budgets have increased in every region, and average rent has, once again, broken records. However, despite the low rental supply in London, there was an interesting increase new listings in the boroughs of Westminster and Tower Hamlets. Sudden opportunities like this will crop up across London through the year, and our local experts work with renters to get them matched and into their new homes at pace in this fast-moving market.”

House sales volumes “not house prices”

Jonathan Hopper, CEO of Garrington Property Finders, said two successive months of slipping house prices confirmed it was no “fleeting wobble”.

“But neither is it the plunge some had predicted, and as a result the predominant trends on the front-line are uncertainty and procrastination.

“Nobody can be sure whether this is the calm before the storm, or if the storm has been averted at the eleventh hour.

“At the top end of the market, where fewer buyers are reliant on mortgage borrowing, many are pressing on with their purchases, albeit with some risk priced into what they’re willing to pay.

“Unless and until borrowing becomes less expensive, many of these buyers won’t be able to proceed and as a result the number of transactions will continue to fall. The squeeze will be concentrated on sales volumes, not prices.”