UK headed for stagnation on worst inflation crisis in G7, IMF warns

A historic hit to Brits’ living standards from roaring inflation and rising interest rates has thrown the UK economy on course to stagnation, the world’s lender of last resort warned today.

The UK economy will grow a better than expected 3.6 per cent this year, according to the International Monetary Fund’s (IMF) latest World Economic Outlook (WEO) out today.

But, growth will stall next year as households bear the brunt of rising prices and higher borrowing costs.

The economy is set to expand just 0.3 per cent next year, lower than the IMF’s previous 0.5 per cent estimate.

Just Germany, Europe’s biggest economy, and Italy will register worse growth than the UK among the globe’s richest economies next year.

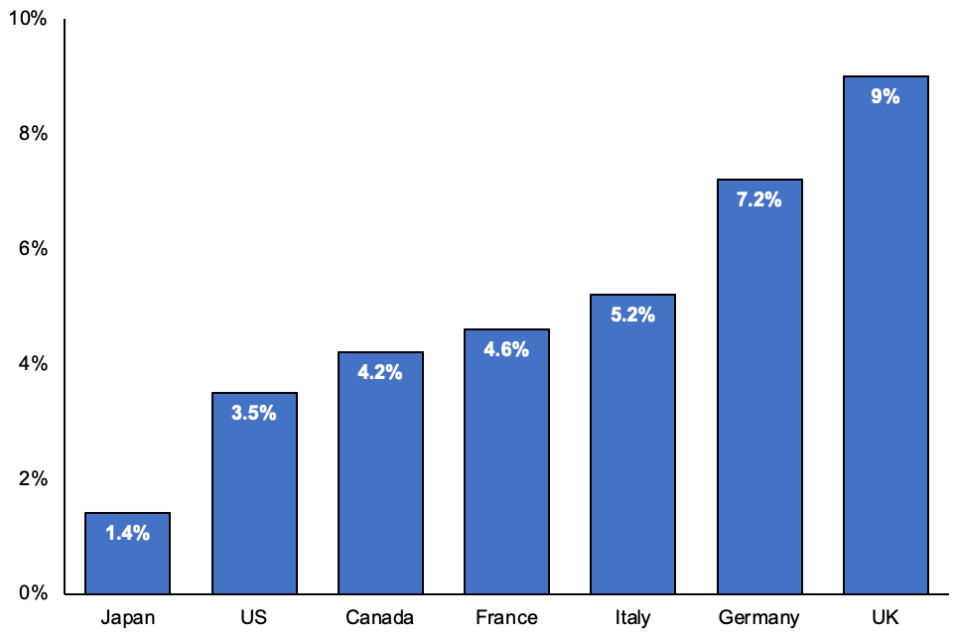

Inflation in Britain will barely fall next year, averaging nine per cent across the whole of 2023, the hottest rate of any member of the G7.

UK on course to suffer longer inflation shock than its peers

The IMF’s forecast did not capture all the effects of the government’s £43bn worth of tax cuts and two-year typical £2,500 energy bill freeze.

“The fiscal package is expected to lift growth somewhat above the forecast in the near term, while complicating the fight against inflation,” the IMF said.

Its chief economist warned chancellor Kwasi Kwarteng and Liz Truss’s decision to inject billions of pounds into the economy through tax cuts and borrowing is offsetting the Bank of England’s efforts to tame inflation.

Fiscal and monetary policy should not work at “cross purpose[s]” as it may lead to “serious financial instability,” Pierre-Olivier Gourinchas said.

“Unfunded government spending increases or tax cuts will only push inflation up further and make monetary policymakers’ jobs harder,” the IMF said in its WEO.

The Bank is trying to curb prices by hiking interest rates, while Truss and Kwarteng have cut taxes in a bid to stimulate spending.

Prices have climbed at the fastest pace in 40 years for several months in the UK, with inflation currently running at 9.9 per cent.

The Bank has lifted rates seven times in a row, including two back-to-back 50 basis point rises, to 2.25 per cent to tame inflation.

Financial markets have been rocked by the prime minister and chancellor’s mini budget last month, forcing UK borrowing costs higher and the pound lower.

As a result, the Bank is expected to launch an at least 100 basis rate rise at its next meeting on 3 November, which would be the biggest move since it was made independent 25 years ago.

The IMF last month urged Truss and Kwarteng to rethink their fiscal plans. The chancellor will meet with IMF officials at their annual meetings in Washington this week.

Consumers are forecast to slash spending and businesses cut investment due to rising prices squeezing their finances, forcing UK GDP lower.

The IMF left its projections for global growth unchanged at 3.2 per cent this year.

Gourinchas added: “As storm clouds gather, policymakers need to keep a steady hand.”

“Increasing price pressures remain the most immediate threat to current and future prosperity by squeezing real incomes and undermining macroeconomic stability.”