UK has insured £102bn worth of Russian oil despite sanctions

A former Cabinet minister has called on the insurance industry to think on its obligations after it was revealed that UK firms have insured over €120bn worth of Russian oil.

From March 2022, just after Russia’s invasion of Ukraine, until the end of November 2023, the UK insured €120.6bn worth of Russian oil, according to an analysis by the Centre for Research on Energy and Clean Air (CREA).

The CREA analysis is focused on the months between March 2022 and November 2023. It is not illegal to transport Russian oil, or insure it, as long as the black gold is sold for less than $60 a barrel.

CREA revealed that 33 per cent of all Russian oil (by volume) was transported on tankers insured in the UK.

Of that, the majority of the Russian oil was crude oil (31 per cent worth €14.4bn), followed by diesel (22 per cent worth €10.3bn).

Alun Cairns, the former Welsh secretary and still Tory MP, said firms must be alive to the possibility that the price cap could be abused.

The analysis noted that while there has been a decrease in insurance companies from the UK covering shipments of Russian crude, Russian oil transits still remain highly reliant on vessels insured in the UK for transport.

In the 12 months since the oil price cap was introduced in December 2022, €46.4bn of Russian oil has been transported on tankers using UK protection and indemnity (P&I) insurance.

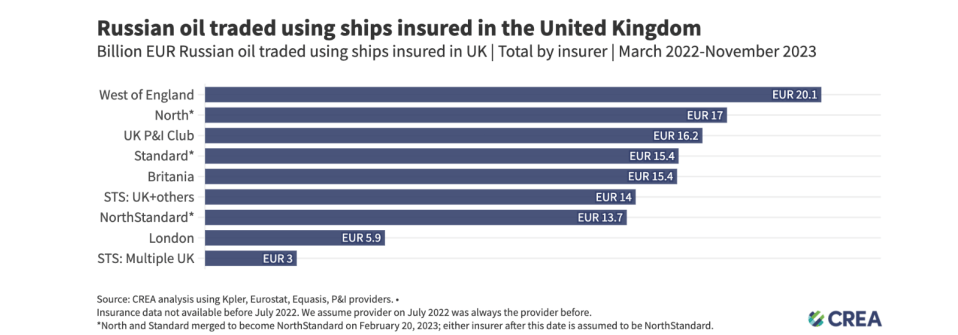

The West of England P&I Club covered the highest value of Russian oil products at €20.1bn, followed by NorthStandard at €17bn. North and Standard insurance merged to become NorthStandard in February 2023.

This comes after Kpler shared data with City A.M. earlier this month that shows that last year was the most active drilling year for Russia through the first 11 months, with a total depth of 28,100 km.

The CREA’s analysis stated that “Russia’s reliance on UK insurance to transport their oil provides the UK with significant leverage which they can use to lower the price cap, and implement better monitoring and enforcement that would considerably lower Russia’s oil export revenues.”

“It also shows the somewhat posturing nature of the support and aid that the UK provides to Ukraine, while at the same time supporting Russia’s ability to fund the invasion by conducting its oil trade easily and globally.”

Cairns has raised the issue of Russian oil shipping in Parliament several times.

He told City A.M., that it took the USA seven years to close all the loopholes on Iranian oil shipping after it instigated sanctions.

“I’m concerned that the same focus isn’t there from the international community when it comes to the Russian oil exports,” he said.

“[In the UK] there needs to be greater coordination between the Ministry of Defence, the Department of Business and Trade, the Treasury and the Cabinet Office.

“There’ll always be someone or an organisation seeking to exploit opportunities. I will be very disappointed if there are UK insurance companies participating in that illicit market,” he added.

NorthStandard were contacted for comment.

West told City A.M.:

“The stated twin aims of the price cap regime are “to deprive the Russian Federation of the revenue it uses to wage its unjust war against Ukraine, while maintaining reliable supply of crude oil and petroleum products to global markets” [OFAC Advisory for the Maritime Oil Industry and Related Sectors, October 2023].

“When undertaking these trades both insurers and shipowners are deemed by the G7 countries that have introduced these Russian oil trade restrictions to be Tier 3 actors. They do not have access to information relating to the purchase price of any particular cargo. The price cap mechanism requires Tier 3 actors to obtain and provide attestations that the cargo being carried was purchased at below the published cap prices.

“If it transpires that an attestation is inaccurate or there is any other sanctionable activity, then insurance cover for the voyage concerned ceases automatically and in its entirety. It is therefore incorrect to suggest that West provides cover for any tanker carrying above cap price cargoes; that is not the case and there is no cover whatsoever for any such activities.

“West is a not for profit mutual insurance association. It abides by all sanctions regimes and has robust compliance policies in place to ensure that Members comply with applicable sanctions regimes.”