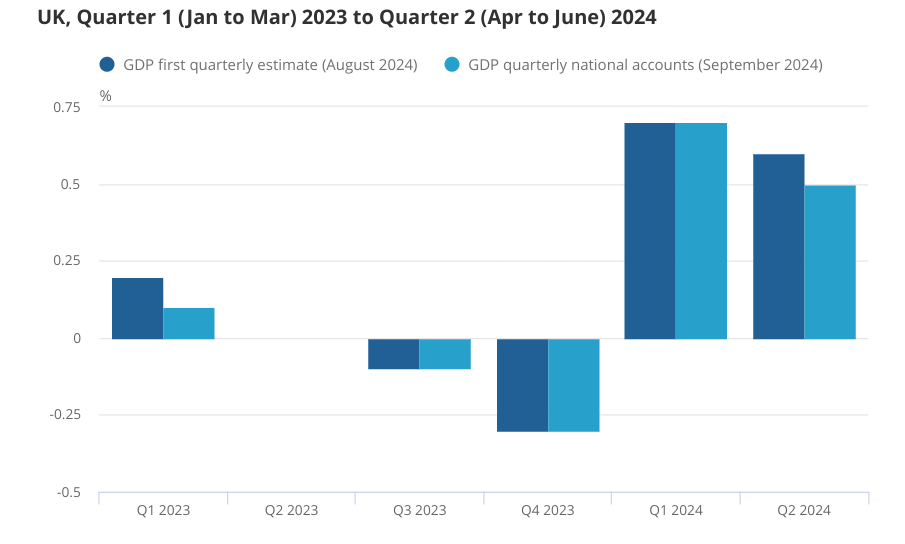

UK growth revised down to 0.5 per cent in second quarter

Economic growth in the first half of the year has been revised down in the latest estimates from the Office for National Statistics (ONS).

The ONS now thinks that the UK economy grew 0.5 per cent in the second quarter of 2024, down from a previous estimate of 0.6 per cent.

The services sector grew by 0.6 per cent in the second quarter, which was partially offset by falls in production and construction.

Growth in the first quarter of 2023 was also revised down by 0.1 percentage points, although the revisions did little to change the overall picture for the past couple of years.

Liz McKeown, ONS director of economic statistics, said the updated figures included new survey data, VAT returns and updated information about the size of different industries.

“After taking on these improvements, the quarterly growth path across the last 18 months is virtually unchanged,” she said.

The UK was among the fastest growing economies in the G7 in the first half of the year as the economy recovered much faster than expected from last year’s shallow recession.

However, most economists think that the UK’s sharp growth rate in the first six months was overestimating momentum in the economy, predicting that it would ease in the second half of the year.

The latest GDP figures suggest that the economy stagnated in July for the second month in a row, although survey data points to a modest expansion.

The updated figures also revised down the UK’s saving ratio compared to previous estimates.

Although the ONS reported an increase in the savings ratio in the first half of this year, the increase started from a lower base meaning savings was actually revised down overall.

The ONS estimated that the savings rate picked up to 10.0 per cent in the second quarter from 8.9 per cent in the first, whereas the ONS had previously assumed the savings rate was 11.1 per cent between January and March.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the revisions “changed the economic story post-Covid slightly” as it suggested that consumers dipped into their savings more than previously thought.

“Consumers have been less cautious, pointing to high interest rates weighing a little less on consumer spending than the MPC had thought,” Wood said.

Matt Swannell, chief economic advisor to the EY ITEM Club, said there was still “scope for dis-saving to support the consumer recovery…(but) that firepower now looks smaller than previously thought”.