UK economy already in throes of drawn out recession, City warns after GDP disappoints

The UK economy is already in recession and Liz Truss’s energy support package is unlikely to lift it out of its slump anytime soon, City economists warned today.

Weaker than expected growth figures from the Office for National Statistics (ONS) today prompted experts to sound the recession alarm.

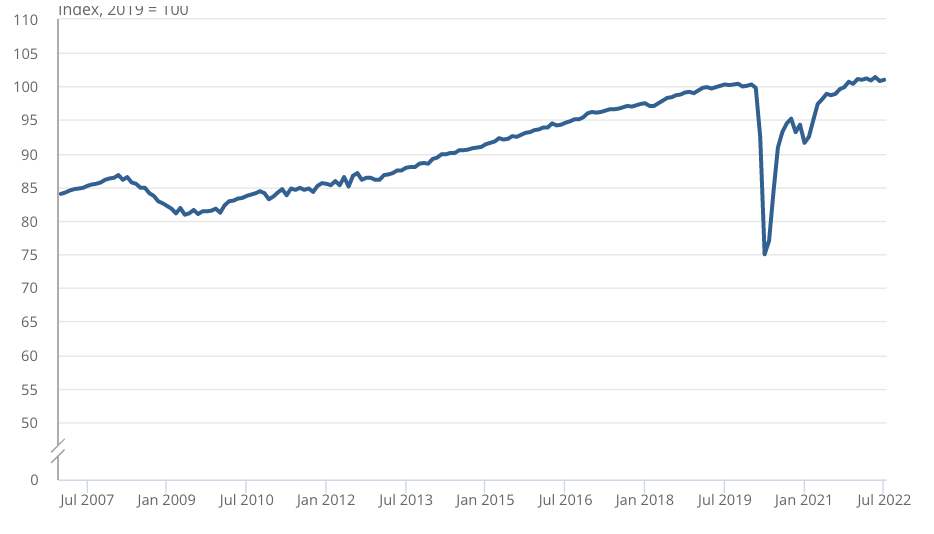

Gross domestic product (GDP) climbed 0.2 per cent in the month to July, lower than the City’s forecasts, but much higher than June’s sharp 0.6 per cent contraction.

July UK GDP shocked to the downside

London’s FTSE 100 bumped around one per cent higher on the news, while the pound strengthened 0.9 per cent against the US dollar.

“The disappointingly small rebound in real GDP in July suggests that the economy has little momentum and is probably already in recession. The government’s utility price freeze is unlikely to change that,” Paul Dales, chief UK economist at consultancy Capital Economics, said.

Investment banks Deutsche Bank and Nomura have also predicted Britain is tumbling toward a technical recession, defined as two consecutive quarters of negative growth.

Last week, prime minister Liz Truss said energy bills for everyone in the UK will be frozen at £2,500 for two years at a cost of around £150bn to the government.

Businesses’ energy bill will also be pegged for six months. Support will then only apply to ailing sectors from next March.

Without that support, households were facing the biggest hit to their spending power on record.

The ONS’s figures revealed scorching inflation – running at a 40-year high of 10.1 per cent – is knocking consumer spending on energy and weighing on GDP growth.

“Anecdotal evidence suggests that there may be some signs of changes in consumer behaviour and lower demand in response to increased prices,” the organisation said.

Fresh inflation figures for August published on Wednesday are anticipated to nudge higher than July’s reading. Truss’s energy support package will curb the expected cost of living peak.

Despite an expected cooling in price pressures, the Bank of England is set to keep hiking interest rates due to higher government spending prolonging the inflation drop.

“Our main concern continues to be that fiscal support to the economy now implies that a more aggressive stance of monetary policy is required to subdue inflation pressures,” Phillip Shaw, economist at fund manager Investec, said.

Governor Andrew Bailey and co had been expected to lift rates as much as 75 basis points this Thursday. However, the latest rate setting meeting has been postponed to 22 September out of respect for The Queen’s passing.

The Bank has already lifted borrowing costs six times in a row to 1.75 per cent.

July’s GDP reading was pushed higher by the extra Bank Holiday in June to celebrate The Queen’s Jubilee cutting output. Economists have forecast the additional lost working day next Monday to mark Elizabeth II’s funeral may tip the UK into recession.