UK GDP: Fourth quarter growth falls short of expectations

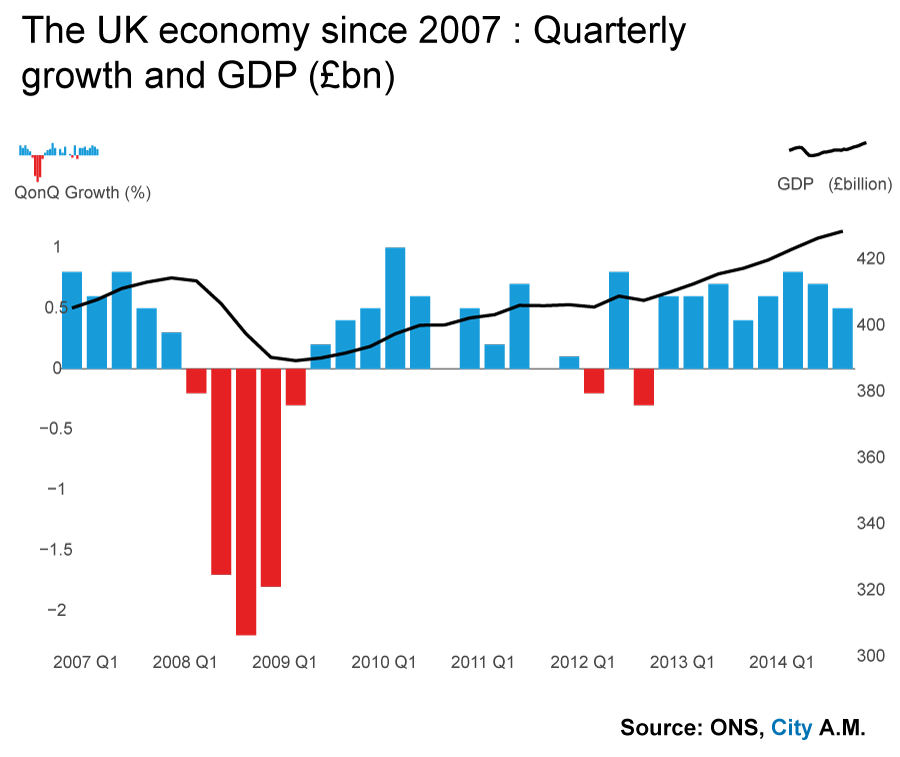

UK GDP growth slowed in the fourth quarter of 2014, coming in at 0.5 per cent and falling short of expectations.

Despite the drop, growth for the year was still 2.6 per cent, the fastest growth rate since the heady days of 2007. Economists polled by Reuters had expected slightly faster quarterly growth of 0.6 per cent. Compared to the fourth quarter of 2013, growth was up 2.7 per cent.

George Osborne has made much of the fact the UK is the fastest-growing G7 economy and today’s figures will no doubt be held up by the Conservatives as further proof that their medicine of austerity is removing the scars of the financial crisis – but he may be worried that the rate of growth is coming down faster than expected.

The growth, as ever, did not occur evenly across the board. The strongest sector was again the services sector, which contributes 78.4 per cent of GDP. That sector grew 0.8 per cent, slower than agriculture, (1.3 per cent) but faster than constructions, which decreased 1.8 per cent.

By weighting its growth rates and contributions to overall GDP, the ONS calculated how each sector affected the figure. Services remain the engine of growth:

Critics argue that the recovery may be built on sand and that household debt levels could soar, especially if house prices drop quickly. Prior to the financial crisis, the debt to income ratio was just under 170 per cent – but the Office for Budget Responsibility expects the figure to reach 184 per cent by 2020. It currently stands at 146 per cent.

James Knightley, an analyst at ING, said the figures suggested "the long-heralded rebalancing story in the UK has completely stalled".

With inflation set to drop marginally below 0 per cent year-on-year in the next couple of months, it is little surprise to see that the market has priced out Bank of England policy tightening for this year. However, the comments from the BoE’s Mark Carney and Kristin Forbes over the weekend suggest that the upcoming Inflation Report may be less dovish than many market participants are anticipating. Consequently, we would be cautious about chasing sterling weaker.